What do businesses perceive as the main risks and challenges they face today and in the years ahead? It’s a question that matters if you want to understand overall business challenges and drill down into more specific business transformation challenges across the industries you’re doing business with.

A good barometer of these perceived risks, indicating the broader evolutions that are on the executive mind, is the Allianz Risk Barometer. The edition 2016 surveyed over 800 risk managers and corporate insurance experts from more than 40 countries and various industries, obviously including the insurance industry itself.

The fear of digitalization, interconnectivity and innovation

In its 2015 edition the barometer found that for the first time ever technological innovation appeared in the top 5 long-term risks facing businesses.

Yet, this year, the overall digital business reality, digitalization, innovation, digital transformation, disruption and the protection of the fuel of the digital economy (networks, data, information and thus people too) are even more on the minds of respondents.

Simply said: most businesses are not just concerned about all aspects of a digital society, digitalizing business environment and ‘digital first’ customer, they are afraid of them and of the technological innovations as such. For more than one reason that isn’t bad at all (change requires recognizing threats and challenges), even if fear is among the well-known inhibitors of change (also and maybe even more so if it’s needed).

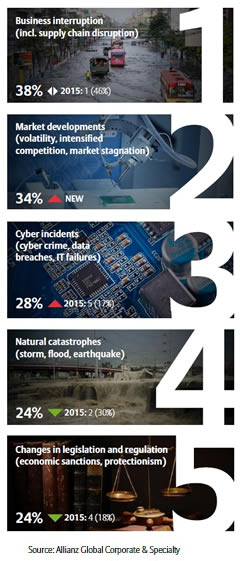

Just as last year, business interruption, including supply chain disruption, is perceived as the key global business risk, the 2016 Allianz Risk Barometer found. However, it dropped compared to 2015 and, more importantly, the perceptions regarding the possible contributors to business interruption have changed.

While new technologies and, more specifically” the impact of increasing interconnectivity and innovation”, only ranked 19th with 3 percent of responses in 2015, this year it ranks 11th with 10 percent.

If you look at the key risks as perceived by respondents it becomes clear that they are highly interconnected and that the digital economy and digitalization play a key role in them from multiple perspectives.

Business interruption: cybersecurity takes center stage as fear of cyber incidents grows

There has been a considerable drop in the perceived risks of natural disasters as business interrupters. However, cyber incidents, inherently part of an increasingly connected ecosystem, enter the top 3 of overall risks with 28 percent of responses. Cybersecurity increasingly becomes a key concern.

Obviously, there is a strong link between business interruption and cyber incidents in an increasingly digital and information-intensive business reality.

Looking ahead, organizations also see these cyber incidents as the main future risk, Allianz reports, and the increasing sophistication of cyberattacks is the main cause of fear in a context of digitalization impact.

Operational and strategic concerns caused by digital technologies and the ways they are used

Yet, it’s not just about cybercrime and security. It’s also about the growing role of increasing digitalization overall and of technological innovation which are anticipated as having more impact in the future according to the survey.

Allianz dedicates a whole section to it, stressing how evolutions in the area of digital technologies – and how they are used – bring benefits but clearly also fears on an operational and strategic level (on top of security risks).

Think about the Internet of Things, (Big) Data, altering working and business environments, fundamental changes in value-added processes and business as such and the integration of digital and physical worlds in a so-called Industry 4.0 context.

The current level of security of connected devices is still low. Cyber security risk will increase as each device is a potential entry point for data breaches and interconnectivity can increase the damage significantly, creating high accumulation potential

From interruption to disruption and increasing competition: market developments

On top of security and technological challenges there is the fear of interruption and disruption due to the business and human challenges brought upon us by new business models and increasing competition, often coming from non-traditional players and ‘disruptive’ newcomers.

With business interruption as the number one global risk concern and cyber incidents being number two, market developments rank second this year. And that’s a remarkable evolution as this category of market developments, which includes volatility, competition and market stagnation, is new.

Although it is about more than the impact of digitalization and disruptive business models, they all play a key role in it. The same also goes for business interruption where cyber risks can have a big impact as said.

Allianz refers to the growing concerns regarding various operational issues which are placing increasing pressure on the markets and challenging business models organizations are faced with.

When market entry barriers come down: core challenges

More intensive competition is in fact one of the main drivers behind the mentioned appearance of ‘market developments’ as a top 3 business risk. And this intensified competitions is mainly coming from non-traditional competitors and agile start-ups, in other words: so-called disrupters which can enter markets easier than ever and can challenge and change markets and traditional business models in a very short time.

With market entry barriers coming down and (the impact of) digitalization speeding up, organizations find themselves with the challenge to perform in a so-called VUCA environment (volatile, uncertain, complex and ambiguous), Bettina Stoob, Head of Innovation at AGCS stresses.

Among the challenges at hand:

- A move from economies of scale to speed to market as the business mantra of the new industrial era where the real-time economy becomes a reality.

- Rapidly shortening innovation cycles whereby organizations needs to be constantly on their toes as Allianz puts it. But also forcing them to innovate and thus be agile, enabling them to tackle disruptive forces and becoming disruptors themselves.

- Involving, understanding and staying extremely close to customers and how they change and need to be put at the center of the business (Allianz stresses the importance of the business community as an asset and peer to peer business as a way for customers/consumers/people to disintermediate and cut the go-between which doesn’t satisfy them).

- The mentioned coming down of market entry barriers with several non-traditional competitors in existing markets, which turn business models upside-down (Allianz mentions usual suspects such as Airbnb in tourism, Apple in automotive, Google in insurance, Paypal in financial services, Skype and WhatsApp in telecommunications and, whom else, Uber in transportation).

Axel Theis, Member of the Board of Management at Allianz SE summarizes the changes in risk perceptions and ways to respond: “Businesses need to prepare for a wider range of disruptive forces in 2016 and beyond…the increasing impacts of globalization, digitalization and technological innovation pose fundamental challenges to many businesses and business models. The world is becoming increasingly competitive as market entry barriers come down.”

Balancing risk and opportunity: four considerations

Looking at the mentioned risk perceptions in Allianz’s annual Risk Barometer there are four things I would like to point out:

Is your business fast enough and do you prioritize YOUR risks correctly?

The fact that risk managers and corporate insurance experts see digitalization and its various consequences (cybersecurity becomes more important, digital innovation is increasingly perceived as a cyber risk etc.) far more than last year when it already started showing, indicates it’s serious. Of course the benefits are seen as well but it’s the first time that risk managers are looking at the factor of digitalization and technological innovation so intensively, pushing them up in the overall business risk picture.

One can wonder why it has taken them so long as digital transformation, the need to enhance the end-to-end customer experience, digital innovation, disruption and the growing number and sophistication of cyber-attacks aren’t exactly new. All these topics should be in the boardroom right now and in many cases (security, customer experience, innovation) they increasingly are. But still. On the other hand we should of course keep in mind that there are more business risks that are on the top lists of risk managers. Among them (and not a surprise either) are political risks (war, terrorism,…), regulatory changes and – growing fast – macroeconomic developments.

Security and data and information quality: core business challenges and priorities to solve now

We can’t emphasize it enough but security and the prevention of cybercrime, data breaches and cyber incidents overall needs far more attention.

When Allianz talks about digitalization, whether it’s the technologies (IoT etc.), the risks, the disruptive models, the advent of non-traditional companies or increasing competition, in this day and age security and data quality/protection/transparency need to be far higher on the list of risks and of priorities overall.

Information and data don’t just need to be protected for all the right reasons (customer trust, reputation – also remaining a top perceived risk – and the fact that all the mentioned topics evolutions and technologies are essentially about information and data excellence in all aspects, from quality and protection to value, customer experience, business processes and interconnection). They also need to be leveraged as core business assets in a holistic way.

Far too many organizations aren’t serious enough about data and information in transformation, nor about security yet, as we’ll cover in a next blog post. Here is the fact: digital business is today’s business and the value it creates in the form of actionable data and information assets will continue to invite ‘the bad guys’ to try to get those core business assets. Security is an ongoing and holistic challenge.

Recognize the risks – avoid stagnation

In order to reap benefits from digitalization it’s key to recognize the risks and tackle them. It’s better to be a disruptor in your industry than one of the many companies being disrupted. It’s better to be the innovator than the laggard. It’s better to stay ahead of the ‘bad guys’ and their cyber threats than having to suffer the costs and consequences. It’s better to increase speed of processes and be more customer-centric than to see the gap with faster, more customer-centic and more responsive competitors grow.

Yet, standing still is not an option. Risks are one thing, dealing with them another. And turning the risky factors into competitive benefits is where true value is created. Fear needs to lead to smart business, not to stagnation when everything around us is changing and nobody will wait until you catch up.

Stay close to your individual customer and business reality

Last but not least and short and sweet: don’t (just) look at the usual suspects that are changing the rules in your industry right now or might do so in the near future. Some of your competitors have understood the challenges and deserve a look as well. They resemble your business more than a lean start-up or technological company changing the game in your business. Also learn from businesses in other industries. But most of all: look at your individual business and customer context, assessing the leaks, organizational hurdles, risks and innovative and cost-saving value creation opportunities, listening to the customer and understanding how technologies and data can help you do better because your customers and key stakeholders tell you, not because of what you are told or believe.

But do keep an eye on those technology start-ups (e.g. Uber) or behemoths (e.g. Google in insurance or Apple in payments) too.