Sensors have become ubiquitous. They have existed since long before the advent of the Internet and certainly before the Internet of Things or IoT. Modern smart sensors enable more applications than ever, and the market is in flux with ample drivers boosting growth.

Cars, cameras, smartphones, and IoT-enabled factory machines are just a few categories of objects and devices that together account for a massive number of sensors.

Take cars, for example. In just a few decades, they have become computers full of technologies that use sensors. Mechanics can tell you all about it: not even that long ago, they were still literally tinkering with defective cars. Today it is all software and technological systems, most of it with sensors.

Sensors in a connected cyber-physical world

With the advent of IoT, the digit(al)ization of manufacturing, which we know as Industry 4.0, and ever-increasing digital transformation efforts in all areas of our economy and society, the evolution of the sensor market is moving even faster with smart sensors being leveraged across industries.

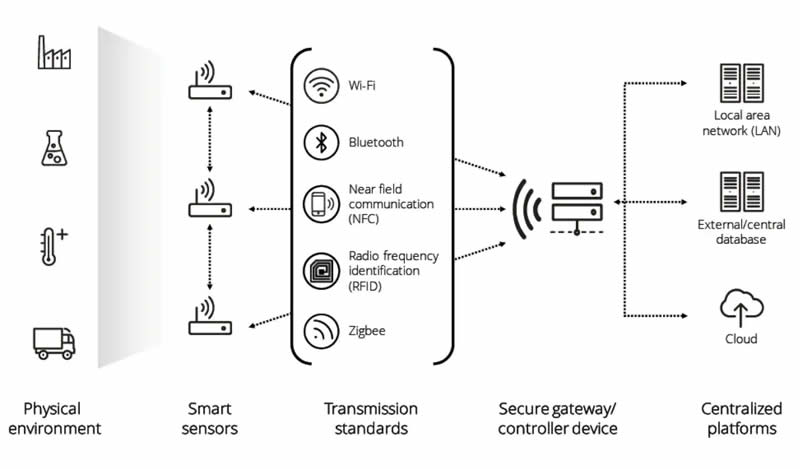

In fact, in a way, smart sensors are at the basis of the ‘real’ Internet of Things. In this phase of IoT deployment, many still look at all those IoT devices to define the Internet of Things. IoT often is seen as some network of connected IoT devices that by definition include intelligent sensors. Well, these devices are sensing devices.

So, they contain sensors and other technologies that enable measuring something and turning what is measured into data that is then used in different ways. The application’s purpose and context (for instance, what connectivity technology is used) determine which sensors are needed, along with required functionalities.

Sensors and smart sensors – what’s in a name?

That brings us to a definition of sensors and smart sensors.

Sensors and IoT devices are the primary layer of the IoT technology stack. They capture the data we need for our applications and communicate this data to higher-level systems. As explained in our introduction to IoT technology, one connected ‘object’ can have several sensors. It all depends on the object and on what level you look at it. Take an intelligent oil rig: it can have tens of thousands of sensors.

The essence of sensors

Sensors are transducers, just like so-called actuators. Transducers convert energy from one form to another. In the context of smart sensors, this means that sensors can ‘sense’ conditions in or around the (state and environment of) connected devices and physical objects where they are used.

Sensors can detect and measure these parameters, events, or changes for the purposes they were designed and communicate about them to higher-level systems and other devices, which can then use this data for actions, analysis, and so forth.

A sensor is a device that detects, measures or indicates any specific physical quantity such as light, heat, motion, moisture, pressure, or similar entities, by converting them into any other form which is mostly, electrical pulses (Allied Market Research)

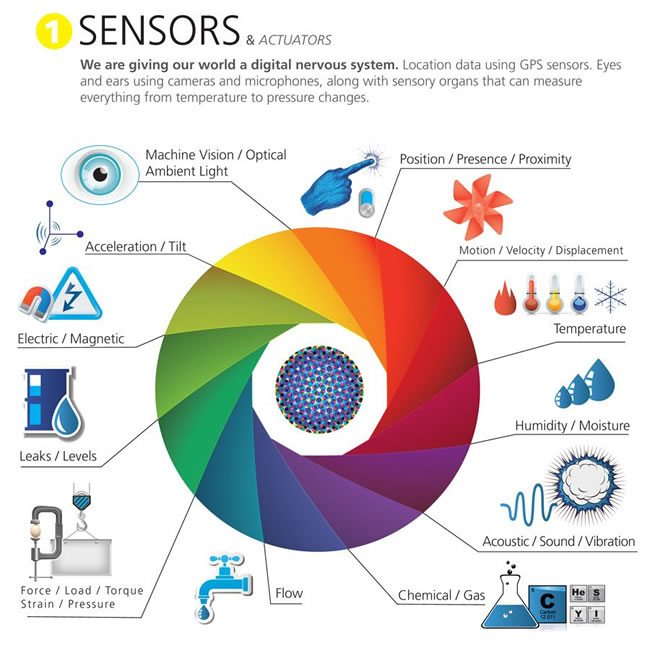

Among the parameters and events that sensors can ‘sense’ and communicate about are physical quantities such as light, sound, pressure, temperature, vibration, humidity, presence of specific chemical components or gases, motion, the presence of dust particles, and much more.

It is clear that sensors are essential IoT components and need to be very accurate because they are where the data gets captured, to begin with.

Whereas sensors sense and send, actuators act and activate. The actuator gets a signal and sets in motion what it needs to in order to act upon/within an environment. The graphic below makes it more tangible and shows a few things we can ‘sense.’ IoT sensors are sold separately, on so-called sensor boards (often designed for specific use cases and applications), and more.

Smart sensors defined

Before we look at some of the major evolutions of the sensor market, a few words about smart sensors. What is a smart or intelligent sensor, for starters?

Adding the predicate ‘smart’ to so many terms also predates the Internet of Things. Smart buildings, smart waste management, smart homes, smart light bulbs, smart cities, smart street lighting, smart offices, smart factories, you name it. And, indeed, smart sensors.

Whereas the former terms (cities, buildings, offices, etc.) can often be viewed from the standpoint of their technical characteristics and/or the perspective of objectives (e.g., putting citizens, residents, people first), the bulk of the literature on smart or intelligent sensors covers technological and functional aspects. This is related to the evolution and history of sensors which, as mentioned, are anything but new.

Smart sensors are different from sensors in that smart sensors are advanced platforms with onboard technologies such as microprocessors, storage, diagnostics, and connectivity tools that transform traditional feedback signals into true digital insights (Deloitte)

In 2009, the International Frequency Sensor Association (IFSA) surveyed several people from academia and industry to define a smart sensor. Most sensors could be called intelligent by then after the switch to digital signals in the 1980s and the addition of ample new technologies in the 1990s.

The 1990s also saw the emergence of the notion of “ubiquitous computing,” which is considered important in the evolution towards the Internet of Things, notably with advances in embedded computing. Around the mid-1990s, the development and implementation of digital electronics and wireless technologies in sensor modules grew whereby on top of sensing, etc., sending data became more and more critical. Today, this is evident with IoT. Before the term IoT was coined, some people, in fact, spoke of sensor networks. So, you see that in 2009 already quite a bit had happened in the space of intelligent sensors.

Still, the term ‘smart sensor’ seemed to be confusing. The majority (61 percent) of participants in the IFSA survey answered that a sensor had an “intelligent function” such as self-identification, self-validation, self-testing, or self-adaptation. Others (18 percent) opted for the “combination of a sensing element, analog interface circuit, ADC (analog-to-digital converter) and bus interface.” A minority preferred a “sensor with only self-checking (self-calibration, self-validation) function” (6%) and a few (1%) a sensor compatible with the IEEE 1451 standard. For 7%, each answer was equally good, and 7% of the respondents had a different suggestion.

Since then, much has changed, and we live in a digital world where modern sensors systems use more and more intelligent functions – on top of those in the survey – and are based on modern microelectronics and MEMS technologies (more on that later).

Base sensors and smart sensors as a platform enabling insights

An essential aspect of smart sensors and IoT sensors is that they thus are really platforms with hardware (sensor elements or the primary/base sensors themselves, microprocessors, and more), those mentioned communication capabilities, and software enabling various functions. Innovation happens in all these areas.

Deloitte made an illustration of the modern smart sensor ecosystem in the context of supply chain innovation, as you can see below. And, as you can read in the corresponding article, Deloitte also has a definition of smart sensors that emphasizes the platform aspect with various technologies and the essential characteristic of the digital insights they provide.

Deloitte defines a sensor as a “device that provides feedback on a physical process or substance in a predictable, consistent, and measurable way,” period. On the other hand, smart sensors are defined as “advanced platforms with onboard technologies such as microprocessors, storage, diagnostics, and connectivity tools that transform traditional feedback signals into digital insights.”

In other words, a smart sensor encompasses more than the base sensor and, as it was called in the International Frequency Sensor Association survey, ‘sensing elements’ for Deloitte as well with the respective mentioned characteristics and technologies.

Moreover, as new technologies such as edge computing become more important, the functions and capabilities of specific sensors continue to increase, making all these technologies possible.

Types of sensors

One way to list different types of sensors is by looking at the attributes they detect and measure. The table below by Yokogawa Electric Corporation offers a good classification that lists common characteristics per type of detection signal.

By way of an example: mechanical sensors, among others, include pressure, vibration, and velocity (speed) sensors, while biological sensors or biosensors come with sensors for various attributes such as sensors to detect the level of glucose, and thermal sensors include temperature sensors, thermal conductivity sensors and so forth.

As you can see, it’s quite a list, and it’s definitely not an exhaustive one.

| Signal | Examples of attributes |

|---|---|

| Mechanical | Pressure, flow rate, vibration, distance, velocity, acceleration, force, etc. |

| Thermal | Temperature, heat, heat flux, heat capacity, thermal conductivity, etc. |

| Electrical | Voltage, current, electric field, charge, resistance, capacitance, etc. |

| Magnetic | Magnetic flux, magnetic field, magnetic moment, etc. |

| Radiation | Infrared, x-rays, visible, ultrasonic, acoustic, radio waves, etc. |

| Chemical | pH, Ion, concentration, moisture, gas, oxygen, etc. |

| Biological | Taste, odor, proteins, glucose, hormones, enzyme, microbe, etc. |

From a market perspective, some of the main types of sensors are touch sensors, image sensors, temperature sensors, motion sensors, position sensors, gas sensors, light sensors, and pressure sensors. According to research (see below), image sensors lead the market, with light sensors being the fastest-growing segment during the forecast period 2020-2027.

The illustration below by the people of PostScapes (which we also used in our article on IoT technology) and is based upon Harbor Research shows examples and categories in a more visual and also non-exhaustive way.

Other classifications are possible. For IoT sensors, you can, for instance, look at the supported communication networks, the purpose of the sensor (e.g., flood sensor), etc.

From a purpose perspective, sensors can sometimes use different parameters. Specific types of sensors such as proximity sensors, for instance, can be based on various features.

Moreover, it’s clear that the general classification with examples in the table above can be further detailed. There are, for instance, many types of gases. Do note that more advanced smart sensors often can sense multiple attributes in one.

Last but not least different types of sensors are also often categorized in function of the industry or market segment.

It’s clear that the Industry 4.0 or Industrial IoT sensor and sensing technologies market looks quite different than that of consumer products such as smartphones and tablets, biomedical sensors, or all the sensors we use in cars whereby we have a vast range, including active and passive sensors, ‘simple’ (base) sensors, and more advanced smart sensor platforms.

Important verticals and market segments for smart sensors include automotive, consumer electronics, industrial, infrastructure (including construction and AEC overall), and healthcare.

The smart sensor market in flux

Time for a look at the evolution of the sensor market. It’s clear that the capabilities of sensors and smart sensors constantly evolve on all levels, including used materials. Of course, what matters most, in the end, is what you can do with IoT and smart sensors.

And then we come to the essence of the Internet of Things: gathering the right data at the right time to gain the right insights for the right purpose in the best and easiest possible way is still essential. The DIKW model indeed also plays its role in the evolution of sensors and IoT.

According to Deloitte, the global market for smart sensors is growing by 19 percent per year.

To achieve the goals of smart sensors in a more complex technology landscape with evolving needs and intensive competition, R&D efforts in the market remain high. Sensors continue to get smaller, smarter, more powerful, and cheaper (see below).

Without smart sensors, there would be no so-called fourth industrial revolution. There would be no smart buildings. No smart city applications. No smart medical devices. The list is endless.

The automotive sector remains an essential factor in the sensor market. Ultimately, the bulk of modern car technologies are based on sensors. But consumer products are also essential. The evolution of sensors for cameras in smartphones is just one example of how fast things are moving.

And, of course, there are the industrial markets where the number of sensors used in a decent industrial transformation project of cyber-physical convergence can be enormous.

We can also expect growth in all the areas touched most by the COVID-19 pandemic. The evolution to smart offices and the future of work, healthcare applications, and all domains in the rethinking of our built environment are examples.

The real growth of the smart sensor market has yet to begin. 5G is coming, people want smart home applications, deployment of the Internet of Things is still limited, Industry 4.0 is slowly evolving, and due to the pandemic, there are more investments in areas requiring sophisticated sensor technologies, to mention some factors.

Perhaps even more important is the fact that prices of sensors have fallen while they get better all the time. This goes hand in hand with the falling prices of chips. Here, too, the automotive sector played a significant role.

There are now shortages of chips for various reasons, but we are seeing that more and more companies are starting to produce them themselves. This trend, which began before the pandemic and was reinforced by it, is interesting because we see more electronics and sensors made for particular applications.

Lower prices are also having an impact on the capabilities of sensors. Manufacturers of sensors don’t want to earn less. So instead of just offsetting price drops, they compete by combining more capabilities in sensor platforms. And that, in turn, causes application possibilities to increase and companies to start projects because investment at the outset is an essential factor.

Finally, R&D investments remain high in the sector, and there is a continuous effort to push the boundaries of sensor technologies as we can’t repeat enough. The Deloitte article offers additional evolutions in the smart sensor market.

The global sensor and smart sensor market 2021-2027

According to a recent Allied Market Research report, the global smart sensor market will grow at a compound annual growth rate (CAGR) of 18.6 percent or $143.65 Bn by 2027 (from 2020).

In the report’s announcement (February 23, 2021), the research firm states that market growth was boosted by increasing demand in the automobile sector, for smart city purposes, and obviously in an IoT context.

The rising adoption of wearables and innovative applications in the biomedical industry should lead to near-term opportunities throughout the forecast period.

One of the factors that inhibit market growth is that integrating smart sensors in devices reduces the lifetime of these devices per the company.

The automotive segment held the largest share of the global smart sensor market in 2019, accounting for around one-fourth of the total market. The automotive smart sensor segment is predicted to grow at a CAGR of 21.7% throughout the forecast period 2020-2027.

When several sectors had to halt their operations during the worst periods of the pandemic, this led to a considerable drop in demand for smart sensors, among others in the automotive, consumer electronics, and industrial markets.

Moreover, as was the case everywhere and as mentioned previously, production and supply chains in the smart sensor industry were disrupted.

Some other findings:

- The image sensor segment that already accounted for the largest share in 2019 (approximately one-fifth of the global smart sensor market) with high adoption in the industrial segment is poised to dominate throughout 2026.

- The highest growth during the forecast period, however, is for the light sensor segment per Allied Market Research. The main reason: increasing demand for smart lights and smart switches.

- From a vertical industry perspective, the automotive segment doesn’t just continue to lead in market share; it will also account for the highest CAGR (21.7 percent) throughout the forecast period. The increasing adoption of electric vehicles is one contributing factor, the emergence of autonomous vehicles another.

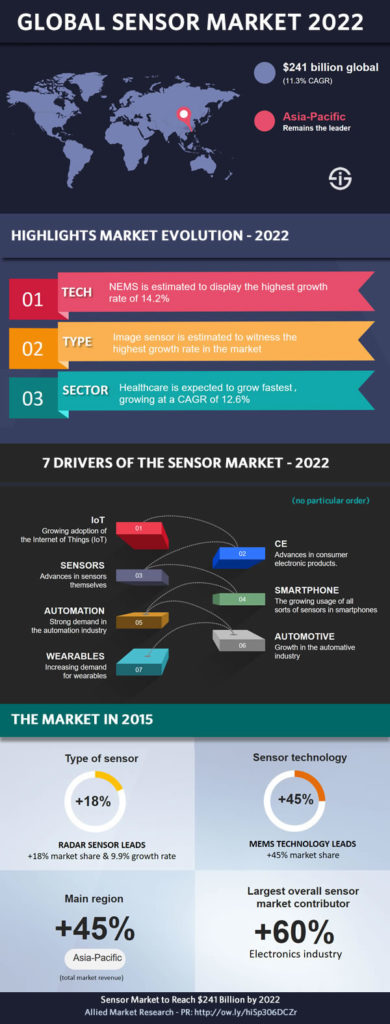

Let’s also look at the sensor market overall with some older findings from Allied Market Research (before the pandemic started).

According to that research, the global market of sensors is poised to grow with a compound annual growth rate (CAGR) of 11.3 percent until 2022. A key driver: again IoT.

To be able to compare with other market research in the space of sensors, first a definition. Allied Market Research defines a sensor as “a device that detects, measures or indicates any specific physical quantity such as light, heat, motion, moisture, pressure, or similar entities, by converting them into any other form, which is mostly electrical pulses.”

Market drivers for the growth of the sensor market

The rising demand for sensors between now and 2022 is mainly due to (in no specific order):

- Inevitably, the growing adoption of IoT and Industrial IoT.

- Advancements in consumer electronics products.

- Advancements in sensors and sensor technologies themselves.

- The increasing usage of all sorts of sensors in smartphones.

- Strong demand in the automation industry (Industry 4.0).

- Growth in the automotive industry.

- Increasing demand for wearables

If we look at the types of sensors, image sensors will witness the highest market growth. From a technological perspective, microelectromechanical systems (MEMS) accounted for 45 percent of the market share in 2015. Nanoelectromechanical systems (NEMS) are expected to be the fastest growers in the forecast period, even if MEMS technology will remain the leader.

Allied Market Research expects the healthcare industry to be a fast grower until 2022 with a CAGR of 12.6 percent as digital health becomes more critical. With the pandemic, this could even be more the case.