What is Sigfox and how does the Sigfox 0G LPWAN network and strategy fit in the broader connectivity landscape of wireless IoT application enablers?

Many IoT use cases require wireless long-range and low-power connectivity solutions whereby relatively small amounts of data are sent, often intermittently.

This is where LPWA networks comes in (LPWAN or low-power wide area networks). The first LPWAN technologies used unlicensed band and they are still a good fit for many applications in areas such as smart offices, many smart building applications, e-health, smart metering, asset tracking, waste management, smart cities, parking garage sensors, smart farming, environmental monitoring and more IoT use cases.

While LPWA network technologies are facing competition from other connectivity approaches, they are part of the offerings of many providers of IoT connectivity, including telecommunication firms. There is also fierce competition in the LPWAN space itself where major players, among others, include the LoRa Alliance, Sigfox and Ingenu. In recent years they were joined by cellular standards such as NB-IoT and LTE-M.

We covered LoRa and LoRaWAN in a first article in this series. In this article we take a look at the Sigfox IoT network approach.

Sigfox: what it is and how it works

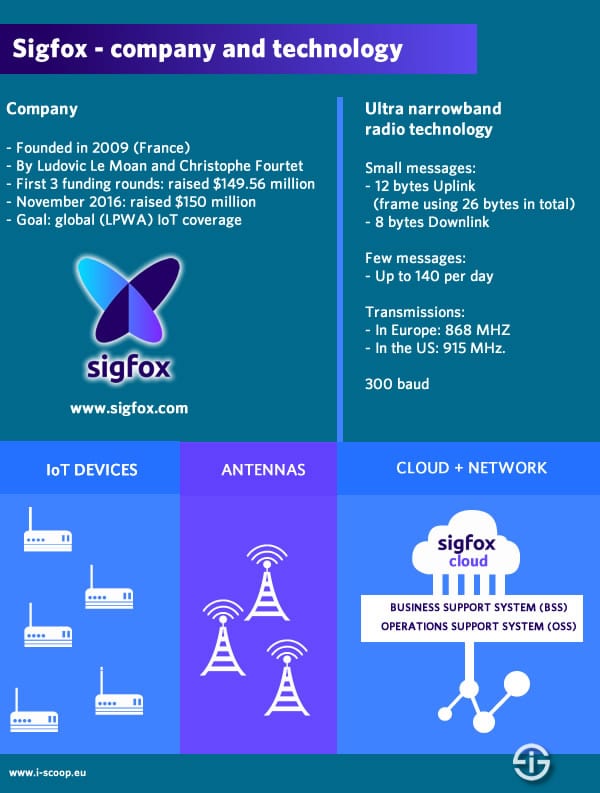

Sigfox is a French company that has been active in the Internet of Things connectivity and communications space since quite some time.

A company with a technology and IoT network operator positioning

Sigfox offers low-powered wide area network coverage with its 0G network. The company positions itself as an IoT network operator.

Just as is the case with the LoRa Alliance, the Sigfox LPWAN approach means connectivity for a lot of Internet of Things applications and use cases whereby long distance, low energy consumption, long battery lives and low bandwidth data transmissions are typical characteristics, as mentioned.

Still, there are technology differences and, at least as important, the market approach of Sigfox is different than that of Semtech, founder of the LoRa Alliance, and its partners, which include telecom firms and companies using LoRaWAN for specific purposes. LoRaWAN is typically also more involved in both public and private IoT networks while Sigfox itself goes for public networks.

Ultra-narrowband technology to build a global IoT network with local ‘operators’

Sigfox uses a cellular-like system with an ultra-narrowband technology. The company works with a range of partners, Sigfox network operators (SNOs), as it wants to build a global IoT network, outside the licensed spectrum.

Sigfox doesn’t only want a global IoT network, it also wants it fast as it repeatedly says. Rolling out as fast and as broadly as possible is key for the company. In order to do so and given its technology, Sigfox needs partners who own high places where they can put Sigfox antennas. This shapes its partner and investor ecosystem because in essence it needs what, for instance, telecom firms and some large industrial firms have: towers (water towers, telecom towers) and other infrastructure such as the high places you, for instance, find in oil and gas, to name a few.

Sigfox 0G in numbers and plans

The French IoT network operator Sigfox covers 72 countries with the LPWAN network, which it dubbed 0G.

The 0G network is low-speed with low bandwidth, and for small packets (max. 12 bytes up to 140 times a day) over long distances. Sigfox claims it has around 7-8 million registered devices on its network.

The precise frequency range and center frequency for ISM applications such as (but not solely) LPWA networks and thus also LPWA networks such as Sigfox depend on the region. Within that sub-gigahertz radio frequency bands space Sigfox uses 200 kHz of these unlicensed bands, more precisely 868 to 869 MHz and 902 to 928 MHz. Again: depending on region. In Europe and the Middle East it’s 868 MHz, in North America and Brazil 902 MHz and in South America, New Zealand, Australia, Hong Kong and South East Asia it’s 920MHZ (all this is regulated, in Europe, for example by ETSI and in the US by the FCC).

A different and proprietary approach

Sigfox has an approach that differs a lot from that of the LoRa Alliance, as mentioned. It typically works with one partner per country or region to deploy its IoT LPWA networks.

It also has a proprietary approach, unlike the more open approach of the LoRa Alliance. This means that you’re essentially talking about one company with its technology and its vast partner ecosystem. Nevertheless, this more proprietary view hasn’t worked too much against Sigfox (and in a sense LoRa Alliance founder Semtech also has some degree of control), as it continues to expand.

Sigfox across the globe: where is Sigfox present and with whom?

Where is Sigfox available and who “offers” it?

Sigfox in Europe

Southern Europe: France, Spain, Portugal and Italy

Sigfox, as a French company with quite some French investors (more below), has a strong footprint in its ‘native’ country.

Still, it was less obvious than one might think. The fact that both Orange and Bouygues Telecom went for nationwide LoRa coverage in France is a factor in this regard. However, with its existing initiatives and partners and thanks to a collaboration with France’s second largest operator, SFR and SFR’s mother company Altice Group, Sigfox now covers the population of France, neighboring Spain, and Portugal.

In Spain, Sigfox works with Cellnex Telecom, an independent infrastructure operator for wireless communications, which is also present in Italy and recently announced the acquisition of Shere Group, giving it access to the UK and The Netherlands. Companies like Cellnex Telecom are obviously ideal for Sigfox as they dispose of sites where Sigfox antennas can be put.

In Italy Sigfox works with Nettrotter.

Sigfox in the UK and Ireland

In the UK, SIGFOX works with Arqiva, also a communications infrastructure company and, among others, an independent provider of telecom towers to mobile network operators, radio groups, broadcasters, utility firms and so on. And, here as well, telecom towers are indeed where Sigfox needs to place those antennas for LPWA network coverage. End 2014, the Arqiva IoT wireless network went live in 10 cities.

Competing with Engie and Telenet in Belgium

In Belgium nationwide Sigfox coverage was done with ENGIE M2M. That’s the Brussels-based Internet of Things subsidiary of French Engie Group, a global player in the energy industry.

The roll-out in Belgium was announced in June 2015.

ENGIE M2M collaborates with Telenet, a telecom firm, which made its existing infrastructure of towers and other high places where the Sigfox antennas can be placed available. In 2021, telecom operator Citymesh acquired the Belgian Sigfox operator ENGIE M2M.

Other European presences

Other countries in Europe where Sigfox is present include Finland, Luxemburg, Malta, Denmark, the Czech republic and Germany.

Finally (and this list is not exhaustive) we also need to mention The Netherlands. As written in our piece on LoRa, The Netherlands was the first country to have nationwide IoT LWAN coverage with LoRaWAN.

Sigfox in the US: 100 cities by end 2016

From Europe we jump to the US where Sigfox has been actively seeking a presence and expansion since 2014 when it started with an IoT network for a part of San Francisco, including Silicon Valley.

In May 2016 the company said it was speeding up deployments in the US fast and aims to move from an earlier announced coverage of 10 US cities to a whopping 100 cities by the end of 2016.

The company claimed in May that this way it had already access to over 230,000 sites, making the goal of 100 cities more achievable.

Moreover, Sigfox also has a partnership with Altice, as mentioned previously. Altice Group is, among others, a cable, fiber, telecommunications and media company with presences in several regions, including Western Europe and the US, operating under different brands.

Asia-Pacific: the next stage

As mentioned in our article on LoRa, Asia-Pacific is a key growth market and many IoT service providers and network facilitators are building out their activities very rapidly in the region with several partnerships.

However, Sigfox has some catching up to do here (mainly in Asia) and it also plans to. In July 2016, Sigfox, Engie (its partner in Belgium and an investor) and IoT network operator UnaBiz announced the launch of Singapore’s first nationwide IoT network. The regional headquarters of Sigfox are based in Singapore. With Unabiz, Sigfox is also present in Taiwan. For 2017 the company is looking at among others India and China.

A key partner in the APAC region, however, is Thinxtra which is creating a Sigfox IoT network in Australia and New Zealand. Thinxtra, a start-up with, among others the CEO of Engie Australia in its board of directors, raised AUD 11 million in 5 months, and covered 33 percent of the population in Australia and 54 percent of the population in New Zealand according to a press release from September 2016.

The company’s goal is to provide coverage to 85 percent of Australians and New Zealanders by the end of June 2017. Moreover, Thinxtra is aiming at more countries in the APAC region, enabling Sigfox to enter these markets faster. With Thinxtra, Sigfox has a clear edge on the LoRa Alliance in Australia and is in a race for New Zealand.

Sigfox in other regions and in other partnerships

Given it’s French roots, Sigfox is very active in French overseas territory. In South America it also operates in Brazil, Mexico and Colambia. Finally, recently Sigfox also started in the GCC region with operations in Oman, together with Omantel.

On top of the various collaborations with its ‘Sigfox Network Operator’ (SNO) partners, whereby, again, Sigfox wants to move increasingly faster, there are also several other partnerships with vendors. An example: end March 2016, Microsoft and Sigfox announced a collaboration to connect Sigfox IoT devices to Microsoft Azure IoT hub.

And obviously there is also an ecosystem of technology enablers, solution enablers such as system integrators and device manufacturers (you can explore the partner ecosystem here).

The thin line between Sigfox investors and partners: on the road to an IPO

Given its more proprietary approach, another difference with the LoRa Alliance approach is that Sigfox heavily relies on funding, yet not with a typical VC approach as mentioned.

When it boils down to funding you clearly see that there are close ties between several investors in Sigfox and various partners. Moreover, several investors also are partners.

Investments and plans

In October news broke that Sigfox was seeking to raise between $100 million and $200 million (at a valuation of approximately $600 million).

Mid november Sigfox announced it had raised 150 million euros (approx $160 million), with amongst others Total and, noteworthy, Salesforce entering in its capital. It’s a well-known fast that the company ultimately eyes and IPO as repeatedly said by its execs.

According to CrunchBase, Sigfox already raised $149.56M in 3 rounds with investors such as Engie (the new name of GDF Suez), other industrial groups such as Air Liquide, tech investors including Intel Capital, satellite provider Eutelsat and telecom operators with SK Telecom Ventures, the investment arm of South Korean wireless telecom group SK Telecom, Japan’s leading mobile phone operator NTT DOCOMO and Spain-based internationally active telecommunications provider Telefónica. Also Samsung Ventures invested in Sigfox and integrates its IoT network protocol in a Samsung platform.

Telecom operators in flux

The presence of telecommunications firms as investors is interesting, certainly as one invested in a competing network, but also because many operators are looking at NB-IoT or LTE-M (both are 3GPP standards). However, this obviously also goes for telecom firms in, for instance, the LoRa Alliance.

Where can Sigfox be used and how is it used?

The list of IoT applications which can be leveraged is relatively similar to that of the LoRa Alliance and LPWAN in general, even if there are a few “technological” differences.

It is important to understand that Sigfox positions itself as a network operator which charges fees. It’s not a hardware vendor and not a solutions provider. So, for examples of how it is used you need to look at its full partner ecosystem which can be consulted via its site via the previously mentioned link. Some of the investors in Sigfox have also built solutions or are helping other solution providers to do so. The same goes for its network partners across various countries.

This is for instance the case with ENGIE, which as an energy firm obviously wants to transform its energy solutions and services.

Is Sigfox better than its competitors?

As said in our article on LoRa(WAN) there is no one-size-fits-all solution. SigFox is more present in specific markets than in others and, just as is the case with LoRa, there are people who point out weaknesses in Sigfox, which then are sometimes refuted by Sigfox.

The competition in the LPWAN market is high and as we have been going through so many cases to prepare the next articles in this series with comparisons, interviews and practical applications it’s become increasingly clear that there is a lot of dicussion going on between various providers and their partners. As we prefer to look at applications we’ll leave those to niche publications, LPWAN industry insiders and the world of rumors – at least for now.

There are debates about some technological aspects and there are discussions about the business model, just as is the case with others. It’s clear that Sigfox is ambitious and growing fast. Our goal is not to go there, again for now, but to focus on real-time Internet of Things applications instead of the hype surrounding IoT.

The Sigfox Monarch cognition service

End September 2017, Sigfox introduced Sigfox Monarch, a pretty important service for applications and devices in an international Sigfox ecosystem context. What you should know about Sigfox Monarch.

The Sigfox Monarch cognition service enables devices to run seamlessly across various regions as it automatically recognizes and adapts to local radio frequencies standards

Without wanting to get too technical (sorry if we did) the point is this: if you have an IoT device in a Sigfox-based application of whatever type, there are several circumstances in which it needs to work in different regions.

By way of an example (and a popular category of IoT use cases in LPWAN that covers many possible “sub forms” of use cases, depending on asset, goal and so forth) think about an asset tracking application.

Of course, asset tracking (or whatever other IoT application) doesn’t always mean different regions with different frequencies, well on the contrary. In these early stages of IoT the large majority of IoT deployments is local (read: tied to a specific region or country).

At the same time, there are applications but also devices that should be able to work everywhere. This is important for IoT device manufacturers too and, in the end, thus again the end customer or consumer (and it’s not, yet at least, that there are easy universal ways for people to do all sorts of IoT device management and device-related IoT platform stuff).

It’s precisely in this context that Sigfox has launched that Sigfox Monarch cognitive service. Cognitive essentially means that Sigfox Monarch leverages some form of ‘intelligent’ software that enables the device to not just recognize the local communication standards (and frequencies) when it’s used but also adapts to them. You immediately see the benefits of what, given the big global ambition of Sigfox really should be obvious but in practice isn’t (or at least wasn’t before).

The result of Sigfox Monarch: “seamless global connectivity” as it’s called (of course where there is Sigfox network coverage, interoperability with other networks is a different story in the strict sense of the word and food for another post).

To cut a long story short and use the Sigfox description: Sigfox Monarch is a cognition service, allowing IoT connectivity anywhere as an extra layer to the Sigfox geolocation service.

Quoting from the press release in which Sigfox Monarch was introduced in September 2017: “Sigfox Monarch provides a unique radio recognition service enabling devices to manage the radio frequency changes, without any additional hardware such as GPS or Wi-Fi chipset”. On top of being a solution for existing customer applications for the travelling consumer using the Sigfox network, Sigfox Monarch enables to build applications and devices across several use cases involving several regions with different Sigfox frequencies

Sigfox calls Monarch “a game-changer for logistics, freight, and consumer goods industries” and gives an example: lost luggage thanks to luggage tracking across the globe, indeed: an asset tracking application. Also think digital supply chain and asset management and maintenance in, for example the shipping industry with sloooooowly moving assets requiring little data and not where you would need constant updates as a container ship isn’t exactly a spacecraft.

On top of that, as mentioned, Sigfix Monarch enables manufacturers of all sorts of consumer IoT applications to make products for consumers, whether it’s ‘smart luggage’, consumer electronics or white goods to, quote, “have a single hardware design for products sold around the world”.

Here too you can of course imagine circumstances where some appliances and devices could benefit from Sigfox Monarch since some people for example like to travel or have the luxury of owning a residence abroad.

As for the name of Sigfox Monarch: knowing that the Sigfox logo shows a butterfly, that all its solutions are named after butterflies (Sigfox Geolocation has been rebranded into Sigfox Atlas) and a monarch, on top of several other things is a butterfly too, the monarch butterfly picture in our illustration probably leaves little room for doubt.

Top image: Shutterstock – Copyright: chombosan – All other images are the property of their respective mentioned owners.