Smart retail innovation requires asking intelligent questions, focusing on the right projects and steering away from thinking in terms of technologies and means to innovate since innovation needs to serve measurable benefits for various stakeholders whereby technologies are enablers. Moreover, retail innovation isn’t (always) about ‘doing more’.

In recent years we’ve been bombarded with all sorts of futuristic scenarios concerning what’s next in retail and what retail innovation could mean. You’ve seen the videos, for instance, on Twitter, on what retail might be in, let’s say, 2045.

There are ample automation, digital transformation and innovation projects in the retail industry. Retailers deal with high competition, price pressure, a connected consumer with high expectations and the impact of e-commerce whereby some of the global giants – from China too – start operations in more countries (and e-commerce is borderless anyway).

While the customer experience remains a driver of retail innovation, retailers now recognize these innovations must also add value (RSR)

With the optimization of the omnichannel buyer’s customer experience as a vital goal (and cost savings always there when we talk about digitization and digitalization), retailers have invested in all sorts of digital projects. Moreover, since physical stores aren’t dead at all, they’ve tried new store concepts (sometimes because they had to) and in-store retail innovations in testing what works and what doesn’t – with some projects having left the pilot stage.

Retail innovations happen everywhere: from customer experience to operations and back

You know the technology dimensions. There is ‘big data,’ with ever more customer data from various sources in a connected online and offline reality with the lines continuing to blur.

There are several use cases of the Internet of Things in retail. And you have many technologies that are used to optimize the in-store shopping experience while enhancing profit by leveraging, for example, advanced analytics and AI-driven applications.

The source of Retail Winners’ motivation to innovate is rapidly changing: 79% say their Board of Directors is demanding innovative new ideas to help satisfy customers vs. 44% of average and lagging performers (Retail Systems Research)

From flow tracking to enable the optimization of the stream, merchandising and the location of goods to smart self-checkout applications or the tools staff needs to inform the consumer right away in-store: the list of applications is endless. We recently talked about some in the context of retail facilities.

Aside from serving king customer, whereby a unified customer data view is critical for retailers (one of the reasons they are among the main investors in customer data platforms; especially the physical/digital data aspect), technologies are essential to enhance operations. All the stuff that consumers don’t see or don’t think about (those refrigerators have to work, shoppers don’t want it to be too cold or hot, energy needs to be saved,…). And, just like in any other industry, connecting the back and front matters in retail innovation.

We could go on about all the innovations that are taking place in retail (which in the end is also a vast category with different innovations per type of retailer), but a more important question in a context of innovation and digital transformation in retail is perhaps one of priorities and smart strategic approaches.

What is the digital transformation strategy and innovation roadmap? What do shoppers want? What are the main pain points to solve? And what do other retailers do to roll out retail innovations that actually deliver?

Retail innovation: the questions to ask

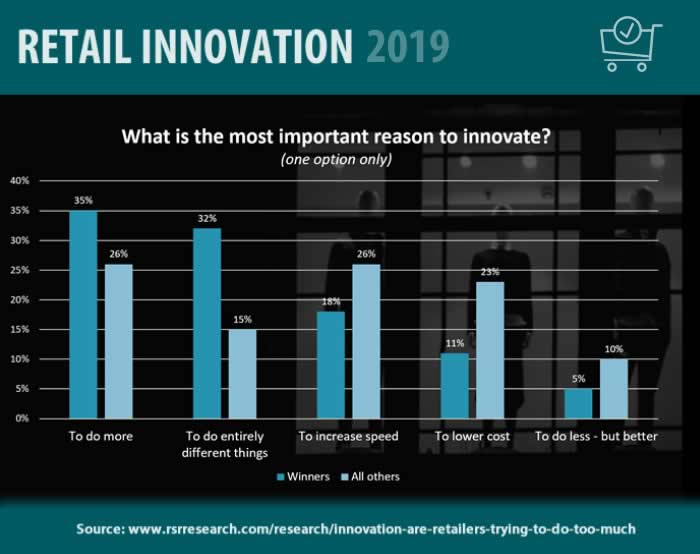

RSR Research zooms in on retail innovation in 2019 in a new benchmark. The attitudes of retailers regarding innovation have matured over the past year the research company says. And those ‘Winners’ approach retail innovation entirely else than others. Let’s take a look.

To announce this 2019 retail innovation benchmark, RSR Research sent the infographic at the bottom of this blog with some of the essential questions to ask. They might seem obvious, but it’s easy to get lost and miss the obvious these days. Proof? With the customer experience remaining a driver of retail innovation, retailers now also recognize that these innovations must add value as well. ‘Keeping it real’ as RSR Research puts it.

Often keeping it real starts with low-having fruit. And often it’s also about the little things; especially those little retail innovation things that can make a big difference.

Or, as the people of RSR Research write in an article on the report “Ultimately, retailers need to come up with an answer to the question, “what’s so good about our experience that consumers will pass up our competition and experience it with us?”, and then absolutely nail it.” Because bridging digital and physical or having a hyper-responsive supply chain, to name two: it’s essential but others have gone there – and will go there.

The simple questions one can ask before starting to innovate:

- Are you focused on the purpose of your planned retail innovation?

- What value will it add (and that of course means goals and metrics)?

- Who will be the beneficiary of the innovation (think broad; staff, customers, shop managers suppliers,….)?

- How will you measure the success of your retail innovation?

Again, it is simple but useful to remind. And the trick is, among others, to:

- Start with those innovations that are needed to remain relevant, profitable and in business;

- Next (or at the same time) look at those retail innovations where little things prove to make a big difference;

- Keep the shopping experience and overall customer experience in mind as it’s where the difference can be made;

- Innovate with the ecosystem of which you’re part as a retailer in mind (the full supply chain);

- Optimize in the back while improving customer-facing operations with the customer always first.

Four retail innovation considerations – learning from the ‘Winners’

The beautiful thing about working in a strategic, gradual way with the metrics, the involvement of ample stakeholders (including the customer) and so forth is that it enables you to focus. And that focus shouldn’t always be on doing more RSR Research reminds. Sometimes it is better to find ways to simplify activities, rather than adding new ones.

How true. Effortlessness, convenience, you know what the customer wants. And it’s not just about making it easy for customers. Simplifying processes is excellent for staff and store managers, for instance. And of course for suppliers.

RSR Research mentions four things to think about in the scope of not always focusing on doing more in retail innovation and of what the ‘Winners’ do to succeed:

- Never forget the customer. Data from the report: 77% of ‘Retail Winners’ believe customer-facing innovations are always important. Bless them.

- Improve processes. The same percentage of ‘Winners’ also believe that process automation of operations is very important.

- The product is really still important. One would forget it with all the digital stuff, but until the day you can print all you want (not), product innovation is still important. One often forgets that this also what Industry 4.0 really, in the end, is about in CPG manufacturing, for instance (so many possibilities there). 72% of ‘Winners’ believe that new product innovation is critical to success (and do notice packaging innovation).

- Don’t forget your suppliers. Two-thirds of ‘Winners’ believe that a mutual exchange of innovations between suppliers and themselves is critical for success. Here is your supply chain and, yes, here are the core ideas behind smart manufacturing and the 4.0 stuff as well. Ecosystems of information and innovation – and always the voice of the customer and his customer as critical feedback for retailers and their suppliers alike (with again ample technologies in the context of Industry 4.0 enabling this for various products).

The report is available for free to registered users so you might want to take a more in-depth look.

To close the loop and bring in technology again, here is another one finding: when it comes to technology, Retail Winners cite new interfaces that incorporate voice recognition as their top priority (68% ascribe high value to it). What’s at the bottom of their list? Robotics and microservices. The other technologies (it appears to be a long list of options participating retailers could choose from) in the report. Below is the retail innovation infographic (full, non-adapted, and large version here).

All images are property of their respective mentioned owners.