The Internet of Things (IoT) is a key driver of digital transformation for years to come, despite all the negativity surrounding IoT by people who see it as a thing.

IoT spending will grow at double-digit numbers until at least 2020. Yet, specific industries, and within these industries, specific IoT use cases, clearly stick out. It probably won’t come as a surprise that the Industrial IoT (IIoT) leads the way.

On top of regional differences there are huge differences in investments, depending on these IoT use cases.

Manufacturing operations, freight monitoring, smart grid, smart home, telematics (insurance), remote health monitoring and digital signage and other IoT retail use cases are among the IoT use cases where spending remains high or increases in the next years.

An overview of IoT spending forecasts per industry, use case and region as announced in the press release of IDC’s Worldwide Semiannual Internet of Things Spending Guide, announced on January 4th, 2017, and compared with other IoT industry forecast we’ve reported on previously.

Update January 2018: check out the forecasts regarding IoT spending in 2018 with new 2021 forecasts

The Industrial Internet of Things remains the main investment area – smart home applications boost the Consumer Internet of Things segment

As mentioned, Industry 4.0 or the Industrial Internet continues to drive Internet of Things spending in the next few years.

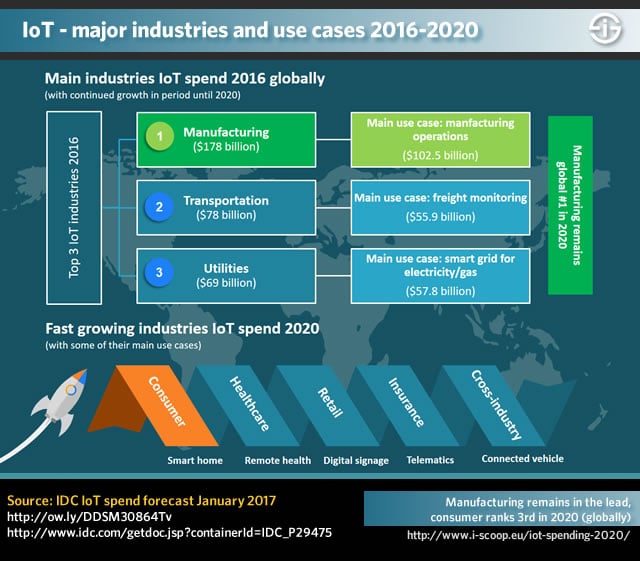

The industries that are poised to invest most in IoT until 2020 are respectively manufacturing, transportation and utilities, all part of the Industrial Internet of Things and all asset-intensive industries, which of course isn’t a coincidence.

While Consumer Internet of Things (CIoT) purchases were the fourth largest segment in 2016, CIoT is only expected to move to the third spot by 2020. The main exception is Western-Europe where Consumer IoT spending is predicted to overtake both transportation and utilities, already moving to the second spot in 2020.

Overall, global spending on the Internet of Things is expected to grow with a compound annual growth rate (CAGR) of 15.6% until 2020 when the market would reach $1.29 trillion. This includes all spending on the various components of the vast IoT technology and solutions space, needed to enable Internet of Things in practice: hardware, software (such as IoT platforms which represent a fast growing market), Internet of Things services (also growing rapidly, with a CAGR of 24% until 2021 according to TechSci Research) and IoT connectivity, with wireless IoT being key for the future.

IoT spending: investments and patterns per industry and cross-industry

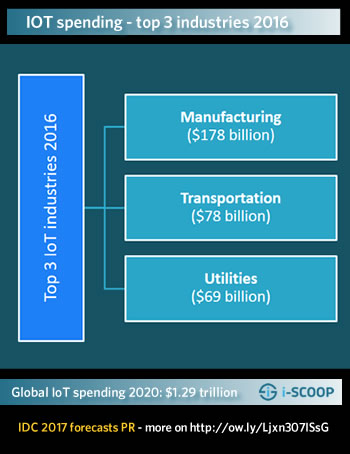

In IDC’s IoT spending forecasts, released on January 4th 2017, the research firms also has data on the top three industries in IoT spending for the past year:

- IoT in manufacturing accounted for $178 billion in 2016.

- IoT in transportation ranked second in 2016 with $78 billion.

- IoT in utilities ranked third in 2016, accounting for $69 billion.

- As mentioned earlier, Consumer IoT spend ends on the fouth spot.

An interesting finding from IDC’s Worldwide Semiannual Internet of Things Spending Guide is that cross-industry IoT investments will rank among the main segments throughout the forecast period. In a sense that isn’t too much of a surprise but it’s good to remind and emphasize it.

Today, on top of looking far too much at devices and IoT endpoints, there is also a tendency to nicely split IoT spending and IoT use cases over various segments. Yet, reality is of course different if you don’t look at spending from a segment perspective but a real-life project viewpoint. De facto, cross-industry IoT investments, representing IoT use cases which are common to all industries, already are important and you can’t simply put them always in compartments. Think about smart lighting projects, for instance. IDC mentions use cases such as connected vehicles and smart buildings in this cross-industry perspective.

Another important IoT spending given is also which industries and sub segments are poised to grow fastest. From an industry perspective, IDC says that insurance, consumer, healthcare IoT and retail will be the fastest growers.

The key IoT use cases from an actual investment perspective

Whereas the overall ranking of segments where most IoT spending happens remains relatively similar and some industries outperform others from a CAGR viewpoint, a lot is happening if we take a deeper dive at IoT spending in various use cases within specific industries. A few examples.

IoT in manufacturing: operations dominate.

Overall, IIoT is still by far the dominant subset of IoT. In the leading IoT industry, manufacturing, operations by far represent the main spending use case ($102.5 billion in 2016 on the mentioned total of $178 billion), outperforming other manufacturing IoT use cases such as production asset management and maintenance and field service. The only exception is the EMEA region, where freight monitoring (transportation) is the main use case, followed by manufacturing operations.

IoT in transportation: freight monitoring first

In transportation, freight monitoring represents an IoT spending of $55.9 billion (on the mentioned total of $78 billion), making it the second largest IoT use case overall from a spending perspective (and first in EMEA). According to IDC, freight monitoring will continue to be a main driver of future spend.

IoT in utilities: mainly a matter of smart grid projects and investments

In utilities, investments in smart grid for electricity and gas total $57.8 billion in 2016. Keeping in mind that total utilities spending in 2016 in utilities is $69 billion, that’s a pretty significant portion, to say the least.

Other vertical IoT use cases which stick out from a spending perspective

It’s clear that in these top three industries the large majority of spending is for specific use cases. And the picture is not different in several other industries and segments.

Take consumer IoT spending, for instance. According to IDC, smart home investments by consumers will double by 2020 to a total of $63 billion by 2020. Put into perspective: that’s more than half than the main IoT use case we’ve mentioned (manufacturing operations) and more than overall spend on that second leading IoT use case (freight monitoring) today!

A few other highlights on an industry IoT use case level:

- In the transformation of the insurance industry, telematics is poised to be the main use case.

- In healthcare IoT, remote health monitoring leads the pack.

- Last but not least, the Internet of Things in retail sees investments in various use cases, including omni-channel operations and digital signage on which we reported previously.

IoT hardware investments: biggest segment but Internet of Things services and software are the fastest growers

If we look at the various components of the IoT solutions technology and services stack, hardware continues to rank first, followed by Internet of Things services (as you can also read here), software (which includes IoT platforms) and, finally IoT connectivity.

The IoT platform market is burning hot. Even if IoT connectivity accounts for the least investments, it’s an area where a lot is moving and happening in the forecast period with the advent of new connectivity solutions in all areas (Bluetooth 5.0, new version of Wi-Fi, Bluetooth Mesh, mobile 3GPP standards such as NB-IoT and 5G , changes in proprietary connectivity by vendors and consortiums for specific use cases, the non-cellular LPWAN space with LoRa and Sigfox leading, and so forth).

Despite the dominance of the IoT hardware market (with a total spending approaching $400 billion by 2020 according to IDC), it’s the slowest growing segment. Both software and services will grow faster than hardware and connectivity as we previously wrote. In hardware, modules and sensors, connecting end points to networks lead, while IoT software spending is dominated by application software (more than 50% of total IoT software spend).

Finally, a look from the regional perspective. As we wrote before, many Internet of Things solution providers have increased their efforts in the APAC region. That’s not a coincidence of course. According to IDC, the APeJ region (Asia/Pacific, Japan excluded) will account for the majority of IoT spending until 2020. The US ranks second, Western Europe third and Japan fourth, making the country a key market for IoT providers.

Top image: Shutterstock – Copyright: chombosan – All other images are the property of their respective mentioned owners.