Gartner released some forecasts with regards to the number of enterprise and automotive Internet of Things (IoT) endpoints in use in 2020.

According to Gartner that number of enterprise and automotive IoT endpoints in use will increase by 21 percent in 2020, compared with 2019. With IoT accelerating digital transformation initiatives, CIOs will have to make their teams focus on supporting the goals of the business units buying IoT-enabled assets while protecting the organization from cybersecurity threats brought by ever more devices and supporting systems in a continuously attack surface.

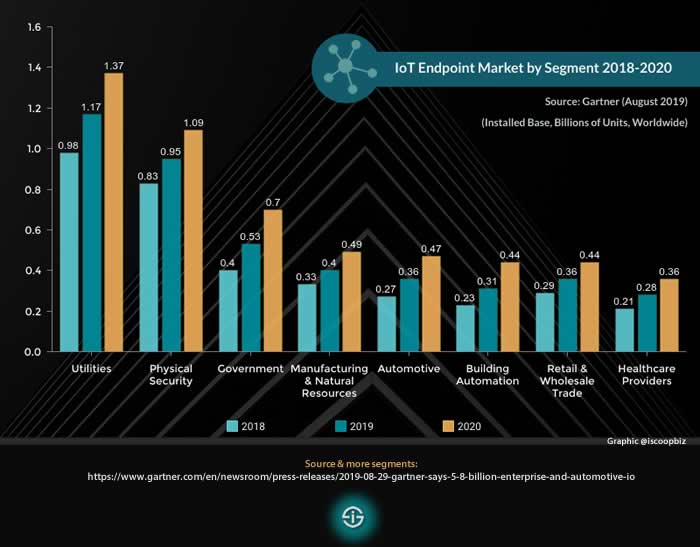

Utilities are expected to be the highest user of IoT endpoints. The fastest growing segment, however, is building automation. The revenue from endpoints electronics is expected to total $389 billion globally in 2020.

Business units will increasingly buy IoT-enabled assets without policies for support, data ownership or integration into existing business applications (Alfonso Velosa, Gartner)

An overview of the industries and use cases from the perspective of the installed base of IoT endpoints in 2020 (and end 2019) with data regarding endpoint electronics revenues. Note: Gartner tracks commercial IoT, industrial IoT and the usage of IoT devices in the automotive industry; in the graphic below all three are represented.

In 2020 the number of IoT endpoints is forecasted to reach 5.8 billion endpoints, as mentioned a 21% increase from 2019.

Electricity smart metering drives the largest segment using IoT endpoints, utilities

The utilities industry is the main user of IoT endpoints. Along with manufacturing (IoT is key in Industry 4.0), utilities have also constantly ranked in the top IoT segments from a revenue/spending perspective as IDC’s IoT 2019 overview again showed.

Within the utilities segment the adoption of IoT will continue to be boosted by electricity smart metering, Gartner senior research director Peter Middleton points out. By end of this year the total number of IoT endpoints in use among utilities is expected to total 1.17 billion endpoints. Gartner forecasts this number will grow to 1.37 billion endpoints (+17%) in 2020, residential and commercial IoT endpoints combined.

Electricity smart metering projects continue to be deployed across the globe for the residential market in the scope of electrical grid modernization, albeit not always with the hoped success. In the commercial market electricity smart metering is mainly a matter of smart buildings and power-critical facilities. Smart metering also boosts the LPWAN market.

Electricity smart metering, both residential and commercial will boost the adoption of IoT among utilities (Peter Middleton, Gartner)

The fastest growing segments in terms of IoT endpoints installed base: building automation, automotive and healthcare

The second largest user of IoT endpoints is physical security, says Peter Middleton. Here building intruder detection and indoor surveillance use cases will drive volume.

With an impressive 42%, building automation, however is the fastest growing segment. Driven by connected lighting devices. In 2018 there were 0.23 billion IoT endpoints in use in building automation, for end this year and 2020, the expected number of endpoints is, respectively 0.31 and 0.44 billion IoT endpoints.

Automotive and healthcare are the next two fastest growers with, a growth of, respectively 31% and 29% in 2020.

North America will see its highest IoT endpoint adoption in building intruder detection, such as door and window sensors, which will represent 8% of total IoT endpoints

The main driver that should result in 0.36 billion IoT endpoints in use by healthcare providers is chronic condition monitoring. With North America by far leading in connected care and several European countries lagging in the digital transformation of healthcare as hospital network CEO Wouter De Ploey recently pointed out chronic condition monitoring for now is a very diverse landscape with big differences in terms of adoption. Yet, the continuing growth is good news for the increasing number of patients dealing with chronic conditions and for mHealth and telecare innovators with chronic condition monitoring solutions who plan to further their international ambitions in more mature markets.

There are obviously more geographical differences in terms of industries and use cases driving the growth of IoT endpoints as mentioned below.

In automotive the main growth is of course for cars with embedded IoT connectivity which per Gartner is supplemented by a range of add-on devices for specific tasks, where fleet management is a typical example. By the end of 2020 automotive is expected to have 0.47 billion IoT endpoints in use and by the end of 2019 0.36 billion endpoints. In 2018, the installed base of IoT endpoints in automotive amounted to 0.27 billion units.

IoT endpoints and endpoint electronics revenue in North America, Western Europe and Greater China

In terms of those geographical differences, there is a difference between the top use cases for Greater China and Western Europe and North America on the other.

For insiders it won’t come as a surprise that smart metering is the top use case in the first two regions, especially in Greater China. Smart metering will represent 26% of IoT endpoints in use in Greater China in 2020, in Western Europe smart metering will be good for 12% of endpoints. In North America, intruder detection is where highest IoT endpoint adoption will be.

IoT endpoints also means endpoint electronics. Here, Gartner shares some findings on regional differences in terms of revenues.

The previously mentioned revenue from endpoints electronics of $389 billion globally in 2020 is concentrated over Northern America, Greater China and Western Europe, together representing three quarter of endpoints electronics revenue overall.

Most revenue is expected to be achieved in North America ($120 billion), followed by Greater China ($91 billion) and Western Europe ($82 billion).

From the use case perspective most money from IoT endpoint technology will be made from consumer connected cars and networkable printing & photocopying, totaling $72 billion and $38 billion, respectively.

The IoT challenges at hand for CIOs and product managers

Gartner analysts will explore how IoT will accelerate digital transformation initiatives. And it’s here that the words of advice for CIOs (or CxOs with similar functions in the sense of supporting business units, enabling transformation and making sure nothing goes wrong while doing so) comes in.

For Gartner, the involvement of the CIO by the way is key for (serious) IoT projects to succeed or, rather, the involvement of the CIO increases the likeliness of success as Gartner analyst Nick Jones says in this Gartner article by Susan Moore.

What we found is that CIO involvement in IoT is critical – projects are more likely to succeed if they are involved (Nick Jones, Gartner)

Gartner research vice president Alfonso Velosa states that ‘overall, end users will need to prepare to address an environment where the business units will increasingly buy IoT-enabled assets without policies for support, data ownership or integration into existing business applications’.

And it’s here that the requirement of the CIO’s team ‘to start developing a policy and architecture-based approach to support business units’ objectives, while protecting the organization from data threats’ comes in as the number of IoT endpoints grows and business units start adopting IoT in industries, including the mentioned ones and others for which Gartner released data on IoT endpoint installed bases, such as retail, manufacturing, government and transportation.

Alfonso Velosa also has advice for product managers. They will need to deliver but also to clearly and loudly communicate their IoT-based business value to specific verticals and their business processes, if they are to succeed in this (still very) crowded space.

Value, business, clarity, integration, policies, ownership and protection indeed. Gartner has more in the report “Scenarios for the IoT Marketplace, 2019“.