There is an increasingly broad range of connectivity solutions which can be used for Internet of Things deployments.

In 2016 we saw a changing landscape with, among others, the advent of new 3GPP initiatives, new/updated consumer-oriented standards and the further expansions of IIoT-specific networks.

Obviously, there is a difference between the best (mix of) connectivity technologies in 1) the consumer IoT space (with among others smart home applications and short-range connectivity needs), 2) applications where a low-battery long-range connection suffices (many use cases with limited data needs such as smart irrigation) and 3) the Industrial Internet of Things as we know it in Industry 4.0 and the Industrial Internet.

The latter, the Industrial Internet of Things (IIoT) is and until at least 2020 remains the main Internet of Things spending perspective (whereby spending includes connectivity), with a leading role for manufacturing.

Industrial IoT connections and Industry 4.0 connectivity in manufacturing

Yet, what are the main Industrial Internet of Things connectivity solutions and how is the number of Industrial IoT connections evolving?

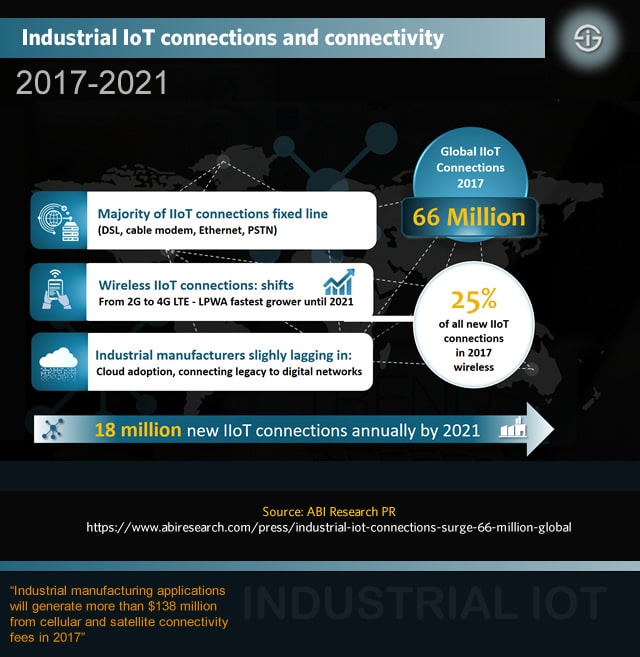

As the Industrial IoT is growing fast it won’t come as a surprise that IIoT connections are growing too. According to March 2017 research by ABI Research, the number of Industrial Internet of Things connections is poised to surge to 66 million global connections in 2017 (note: ABI Research mainly tackles manufacturing, in other words: Industry 4.0).

That’s a total of over 13 million new wireline and wireless connections which is added to the installed IIoT connections base of over 53 milion connections in just one year.

Industrial IoT connectivity evolutions: wireline leads, LPWA fastest grower

The press release from ABI Research sums up some key takeaways:

- Industrial manufacturers (Industry 4.0) still lag a bit behind in the adoption of cloud-based services and the connection of legacy systems to digital networks.

- Despite this phenomenon, IoT visions take shape and industrial manufacturing operations are expected to generate over $138 million from cellular and satellite connectivity fees.

- The majority of new Industrial IoT connections will occur in the APAC region, which accounts for pretty close to 40 percent (5 million on a total of 13 million) of all new connections.

- The majority of connections concerns wireline connections with fixed line methods such as DSL, Ethernet, cable modem and PSTN.

- In the wireless connections and connectivity area, there is a shift away from 2G to 4G LTE, while wireless connections account for 25 percent of all new IIoT connections in 2017.

- In the low-power wide-area space (LPWA), ABI Research expects that LPWA will see the most growth of all IIoT connection technologies in the period 2017-2020.

generate more than $138 million from cellular and satellite connectivity fees in 2017 (ABI Research)

Looking further ahead and beyond the increasing role of LPWA in the next four years, ABI Research expects that over the next years there will be annually 18 million new Industrial Internet of Things connections.

In other words; the industrial Internet market keeps growing and accelerates, from a connections perspective as well.

The bad news for providers of IIoT connectivity: although connections are increasing fast, by 2021 connection-related revenues will decline to $122 million.

Industrial IoT and IIoT connectivity as enablers of digital transformation in manufacturing

Jeff Orr, Research Director at ABI Research states that as the costs for data storage and processing significantly dropped, the digitization of industrial equipment is feasible for all manufacturers, with new applications (tackled previously on our site) such as predictive analytics and digital twin simulation.

And of course there is the higher-level goal of digital transformation in manufacturing and the leverage of the Internet of Things in manufacturing which goes beyond the traditional benefits in areas such as optimization and innovation but is more about innovation, tapping into new revenue sources, as-a-service models and even business model transformation.

The Industrial IoT, and within that reality, connectivity is a crucial way of getting there.

More in the press release and in ABI Research’s Industrial Internet Connectivity Tracker market data report.