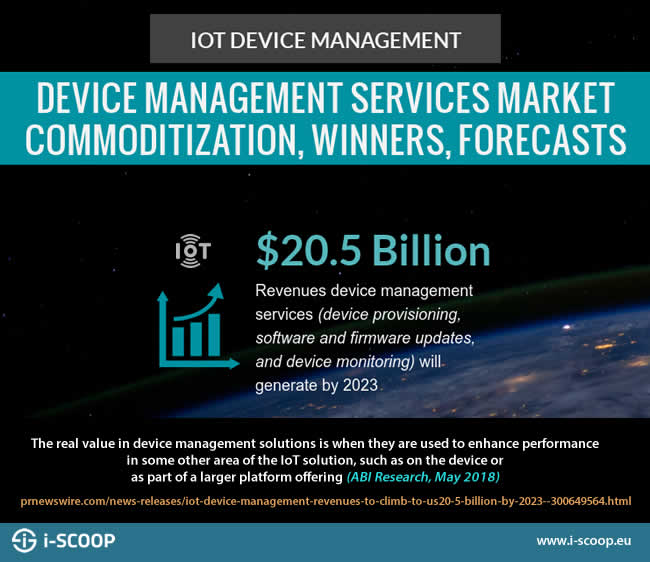

Customers see IoT device management as part of the solutions they seek to deploy. This contributes to commoditization of IoT device management services with more competition and partnerships between vendors in the broader IoT platform and solution ecosystem. While device management services are expected to reach US$20.5 Billion by 2023 the winners will be those integrating and extracting value for the whole ecosystem ABI Research finds.

As the focus in IIoT and Industry 4.0 types of IoT projects shifts towards analysis of data at the edge, with fog computing and edge computing, and as IoT security and data protection become more important on all levels, the importance of enhanced IoT device management is high.

Pretty much all initiatives in the IoT platform market, whether it concerns faster device onboarding as Intel started a while back, adding 4D Analytics as Teradata did or alliances such as the one between Orange Business Services and Siemens (device management, connectivity and an excellent AEP), can be – at least partially – seen in that scope.

Along with the crucial role of device management, certainly now and especially in large IoT projects, IoT projects where real-time analysis and prioritization of IoT data sets is key (e.g. critical power facilities, healthcare facilities, industrial applications etc.) and in use cases that typically need a mixed approach with edge capabilities, the market for IoT device management services is changing.

This isn’t just the case for the IoT platform market where indeed edge platforms and the device management functionalities of application enablement platforms are evolving on technological levels and with regards to the partnerships the vendors strike with other platform vendors that add to the overall device management and security capabilities. On top of ample initiatives in recent years and the examples mentioned above, the new release of Cumulocity IoT is a good example and, where it concerns device management and security, the partnership between Device Authority and Gemalto most certainly is another one.

Device management services in IoT: a market of US$20.5 Billion with moderate growth but enormous challenges and shifts ahead

According to ABI Research there is somewhat of a “device management commoditization”. However, the company does see value for those IoT ecosystem stakeholders that integrate device management with other components of the IoT value chain to create “a differentiated solution that drives value for both end-users and providers”.

In an article on edge platform selection we dive deeper into the various capabilities that are needed on the level of, among others, device management in a changing market. And in article on IoT device management you can read how the market is still growing. Earlier also IDC looked at the topic when assessing the device and network connectivity provider platform landscape.

Combined they give a pretty thorough overview of the evolutions and trends. Still, the advice of ABI Research in the mentioned scope of extracting value across the value chain with first signs of commoditization on a device management level is important.

According to a report by ABI Research, announced on May 16, 2018, IoT device management revenues are expected to climb to US$20.5 Billion by 2023 (that’s the market of device management services, which include device provisioning, software and firmware updates, and device monitoring).

ABI Research states that device management services will be a necessary component of any significant IoT solution moving forward, with 70% of revenues being generated within the industrial, automotive, and telematics verticals.

Research Analyst Ryan Harbison, who speaks about that device management commoditization which is happening to some extent and covers the mentioned value extraction: “the real value in device management solutions is when they are used to enhance performance in some other area of the IoT solution, such as on the device or as part of a larger platform offering.”

It’s indeed again the mentioned ongoing shifts in the market whereby players of various backgrounds forge the proper partnerships and one integration and collaboration follows the next as IoT, with some delay, is being increasingly deployed across several use cases and vendors know where to head next in the bigger IoT solution picture whereby customers want easy and end-to-end solutions.

As examples of companies/vendors enhancing performance on the device, Ryan Harbison mentions players like Telit, Sierra Wireless, Cradlepoint and Eurotech. Among those who enhance performance as part of a larger platform offering he mentions players like Bosch, Mentor Graphic and Wind River.

Obviously, there are more and there are still quite some shifts ahead of us as the ecosystems and various players are looking at that bigger perspective in which, again, you can pretty much see most IoT platform deals and partnerships being made.

Device management services for the edge-centric IoT: the winners in the device management services market and a few words for buyers

Back to the ABI Research IoT device management services forecast announcement. The company found that revenues as a percentage of overall device and application platform revenues will remain relatively constant throughout the forecast period as the US$20.5 Billion forecast indicates.

The reason is that commoditization but most of all what’s behind it as platforms evolve: providers and users see the device management services as a necessary component of any end-to-end IoT solution. The commoditization of device management services will also continue, driven by competition among existing service providers, the growth of standards in the market, and new device management solutions from existing cloud providers such as Google, AWS (Amazon), and Microsoft, says ABI Research.

And that brings us back to Ryan Harbison: “The companies that are succeeding in this space are not pure-play device management providers but are rather those that integrate their device management offerings with other IoT solution components to drive differentiated value for the IoT market as a whole.”

The next moves and partnerships will continue to follow fast. For buyers it means that it’s even more important to inquire about platform vendor and other vendor plans for collaboration, integration and the ecosystems of partnerships and, undoubtedly, acquisitions ahead.

On top of an exploration of the mentioned and other trends it also looks at the essence of device management services, , looks at the role of standards and profiles following device management vendors: ARM, Ayyeka, Bosch, Cradlepoint, Digi International, Eurotech, InterDigital, Lantronix, Litmus Automation, MachineShop, Mentor Graphics, Nokia, Noregon, Sierra Wireless and Wind River, followed by the necessary recommendations.