After NB-IoT and LTE-M networks started being rolled out and the first devices supporting these standards shipped, the term ‘Massive IoT’ (Massive Internet of Things) increasingly was used to describe applications with lots of relatively low-power and low-cost devices offering extended coverage with small data volumes and throughput needs.

These are mainly used in Industry 4.0 and Industrial IoT (IIoT) use cases, enterprise IoT and areas such as agriculture and smart cities, to name a few. Massive IoT fits in the view of Ericsson on cellular IoT with NB-IoT and Cat-M (LTE-M is Cat-M1, Cat-M2 isn’t available yet) or eMTC playing an essential part on the road to 5G.

In its Ericsson Mobility Report November 2019, Ericsson provides some forecasts on the cellular IoT market and for the first time, also on these massive IoT cellular technologies enabling massive IoT applications. If you think that massive IoT is the same as LPWAN (low-power wide-area networks), you’re mostly right. On a technology and capability level, there are, of course, differences between these massive IoT cellular technologies and non-cellular LPWAN options such as LoRa and Sigfox.

Massive IoT primarily consists of wide-area use cases, connecting massive numbers of low-complexity, low-cost devices with long battery life and relatively low throughput

One of them is simply the fact the former enables IoT connectivity in licensed spectrum, and the latter doesn’t. Yet, on a level of applications, there is quite some overlap (details to look at when picking a solution include latency, mobility, network support and QoS, indoor and underground coverage, power-saving techniques, and of course the requirements of your application and ample practical and business reasons).

Massive IoT: where we come from

While the Ericsson Mobility Report November 2019 looks at all mobile network technologies for all purposes, including IoT, and most attention obviously goes to 5G, recently again touted as a critical enabler of the smart factory, the report also looks at those ‘massive IoT’ technologies.

On a side note: in a context of IoT and IIoT, 5G is certainly not here yet and despite the focus on use cases in Industry 4.0 and, obviously, the automotive industry, to mention a few, a first major 5G cellular IoT use case will be homeland security with surveillance (cameras) as Berg Insight points out. The reason why NB-IoT and Cat-M/eMTC/LTE-M (the terms are often used interchangeably) and thus massive IoT are deemed necessary for 5G, by the way, is that both will support in-band deployment with 5G NR.

Before looking at those massive IoT connectivity forecast, a few words on the present and past of 3GPP standards NB-IoT and eMTC. NB-IoT and LTE-M networks have been rolled out by mobile network operators (MNOs) across the globe, and many are still in the process of doing so.

Ericsson forecasts that the number of cellular IoT connections will reach 5 billion in 2025 with massive IoT cellular technologies NB-IoT and Cat-M expected to account for over 50 percent of these connections

Both cellular IoT standards primarily were an answer from the mobile industry to non-cellular low-power wide-area network technologies which were – and still are – offered by the pioneering LPWAN likes of the LoRa Alliance and Sigfox and were far more suited for the needs of many IoT applications than existing cellular offerings.

Yet, NB-IoT and Cat-M so far haven’t been the success stories as one might be made to believe with all the network rollout announcements. We’re not going to repeat all the issues, let’s mention a few.

As Nick Hunn explains, two industry groups had different approaches with regards to NB-IoT, for instance, and both were included as the 3GPP was rushing with standardization: on the one hand, Nokia, Ericsson and Intel, and on the other the ‘clean sheet’ approach, led by Huawei and Vodafone. In case you want to read more about ‘the history’ of NB-IoT and Cat-M, Hunn is definitely one of the insiders whose older blogs you might want to check.

Monetizing massive IoT connectivity and solving the challenges at hand

Anyway, this wasn’t the only issue although it came with severe consequences. Many operators only start to do some more or less interesting things with the first use cases for both massive IoT approaches now, and, all in all, it’s still a bit of struggle.

Moreover, as the people from AllThingsTalk who’ve been working with operators in launching their NB-IoT and Cat-M/LTE-M offerings reminded us, for mobile operators selling IoT solutions isn’t particularly what their sales teams are most used to, nor is IoT connectivity. Part of the success of the company, now acquired by distributor ALSO, and of similar ones is its capability to come with a value proposition for MNOs that included kits for customers to get started, an IoT platform (that MNOs can also use in a branded version) and the fact that the SIM cards are pre-provisioned in the kit; in other words fulfillment (as Tom Casaer, CEO of the company, reminded, ARPU or average revenue per user isn’t too high in this market and shipping SIM cards is a cost also).

There are also still network hardware, and connectivity module issues with regards to NB-IoT and LTE-M, and, last but not least, in the regions where going for LTE-M first technologically was seemingly the most obvious things to do, customer demand more or less forced operators to also offer NB-IoT (notably the case in the US, in Europe, for instance, NB-IoT came first).

To summarize: the deployment of NB-IoT and LTE-M has been delayed quite a bit, according to research published in June again with another 12 to 18 months, also because of short-term uncertainty. That’s on the past and present of these so-called massive IoT cellular technologies with an important reminder: the success of NB-IoT and LTE-M isn’t in the number of MNOs having rolled out networks.

NB-IoT and Cat-M connections 2019-2025

Now the future with the Ericsson Mobility Report November 2019 – per Ericsson that is. According to that report, massive IoT technologies NB-IoT and Cat-M1, which, as said continue to be rolled out, saw an increase in connections by an estimated factor of 3 to reach close to 100 million NB-IoT and Cat-M1 connections by the end of 2019.

With regards to cellular and IoT/M2M, 2G and 3G connectivity, however, still accounts for most connections as ample research firms found before with quite some significant differences.

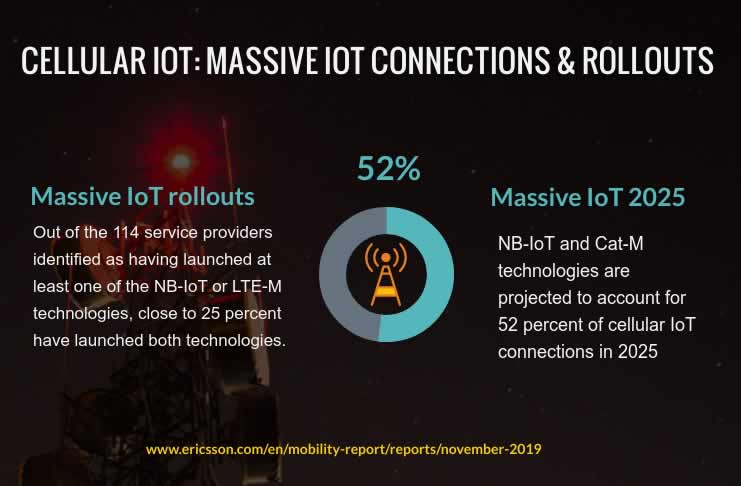

Nevertheless, according to the Ericsson Mobility Report 2019, NB-IoT and Cat-M are projected to account for 52 percent of all cellular IoT connections at the end of 2025. NB-IoT and Cat-M complement each other, Ericsson says. From a market perspective, another way of putting it might perhaps be that they fit different use cases.

Out of the 114 service providers identified as having launched at least one of the NB-IoT or LTE-M technologies in October 2019, close to 25 percent have launched both

The massive IoT cellular technologies had their growing pains. According to analysts, many network hardware and connectivity module issues have been solved. The questions regarding eSIM/iSIM and the merging of NB-IoT and LTE-M into 5G standards that keep OEM and organizations from deploying are addressed and it seems the momentum for, primarily, NB-IoT but also for LTE-M could be gradually starting.

On top of the relatively modest growth of connections in 2019 and the more bullish projections for end 2025 it needs to be said that per the most recent data from GSA (October 2019) Ericsson refers to there are now 114 service providers offering massive IoT connectivity with close to 25 percent of them having launched both NB-IoT and LTE-M (which puts that number of 100 million connections globally in perspective).

Industry experts also see the public LPWA network future mainly going to massive IoT technologies with NB-IoT and LTE-M and with an important place for LoRaWAN in private networks, although the last word on the evolutions of the various technologies and ecosystems certainly isn’t said and there are evolutions on all fronts.

In the meantime, with LTE-M roaming and global NB-IoT network partnerships starting, it’s waiting and see, keeping in mind that some mobile network operators have quite mature offerings and the massive IoT Asia factor, if massive IoT cellular technologies will indeed account for over half of all cellular IoT connections by end 2025, followed by those other categories which Ericsson defined; ‘Broadband IoT’ and ‘Critical IoT’ (4G and 5G), and by legacy 2G and 3G connections which remain quite high and impact the decisions of some operators.

Forecasting is tricky, even more so for vendors. And mobile network operators won’t make it with just the revenues from connectivity, still a tiny part of the market with low ARPU, of course, and investments in 5G to gain back as a critical priority for many.