The oil and gas industry is digitizing and digitally transforming.Oil and gas industry experts from companies such as Halliburton, ENI, OMV and Petronas share their priorities and views with a focus on Industrial IoT, big data, the edge and artificial intelligence – we added recent data on technologies in oil and gas.

The oil and gas industry comes with very specific digitization and digital transformation challenges, among others depending on the process and operation. In the digitalization initiatives of the industry, the Industrial Internet of Things, big data and artificial intelligence play a major role.

Yet, the Internet of Things and related technologies are just one part of the evolutions and opportunities. In this interview, four industry experts share their views on the industrial digital revolution (Industry 4.0) taking place in the oil and gas industry.

The main advantages of IIoT solutions in upstream operations are the low cost of supply, increased production and higher safety (Satyam Priyadarshy, Halliburton)

Industrial IoT, digital technologies and digital transformation in oil and gas with Sharul A Rashid (Principal Engineer, Instrument and Control at Petronas), Satyam Priyadarshy (Technology Fellow & Chief Data Scientist at Halliburton), Sergio Zazzera (Vice President IT Technical Scientific Data and Systems at ENI) and Ricki Koinig (Global Head of IT Strategy and business integration at OMV).

Digital evolutions in oil and gas: industry impact

From your experience, how should oil and gas companies see the current digital evolutions and how will business models in the oil and gas industry be impacted and changed?

Satyam Priyadarshy (Halliburton): The oil and gas industry started its digital revolution a decade or so ago. This first revolution is now known as digital oilfields or some variant of it. To a large degree, it entailed digitization and some effort towards digitalization.

The benefits gained from digitization and digitalization have not been significant though. An example: the industry is implementing integrated reservoir management but if you look under the hood, the integration is still narrowly focused in a siloed environment and tightly controlled.

When we talk about digital transformation, one needs to remember it is about the breakdown of silos, both cultural and technical, so we can transform the way we do business in day to day life.

Oil and gas industries need to leverage digital technologies at a much faster pace, with an agile and adaptable mindset.

The business strategy around digital transformation should include a component of innovation, talent and real transformation of the industry. The sector can certainly learn from the Smart Transform SM approach that we have developed at Halliburton.

Sharul A Rashid (Petronas): In my view, a digital revolution should benefit the company in terms of improved plant operations, which lead to cost savings and Earnings (EBITDA).

Sergio Zazzera (ENI): The digital evolution we see now is a great opportunity for oil and gas companies because it enables a deep transformation of the legacy operations, hardly challenged by the recent crisis.

Historical data from sensors, when analyzed using big data solutions, help oil and gas companies predict the potential possibility of failure of equipment or production disruption

I am thinking not only about the possibility of further automatization of the processes but also about approaching the activities of the sector in entirely new ways (exploration, drilling, operations handling, etc.).

Ricki Koinig (OMV): Over the years there has been much talk about how Business and IT must work together to move digital transformation forward, and much has been accomplished in terms of bridging functions, cross-divisional innovation budgets and a cooperative shift of skills and capabilities from Business to IT and vice-versa.

In the coming years we will make the next evolutionary step towards integrated digitalization roles, and no longer feel a difference between resources coming from either an IT or a Business background.

This mindset change will uncover benefits of fully integrated departmental, financial and operative business and thus accelerate efficiency levels across the organizational model.

The Industrial Internet of Things in upstream and downstream operations: benefits and opportunities

How do you see the role of the Industrial Internet of Things in oil and gas? What are the key benefits and opportunities of using IIoT solutions in the upstream and downstream operations?

Ricki Koinig (OMV): Some specific examples include the main benefits from reduced downtimes of equipment in both upstream production and downstream refining, using predictive maintenance.

Remote operations of assets in hazardous areas and Smart Textiles/Wearables will also contribute to enhancing workers’ safety.

Satyam Priyadarshy (Halliburton): Industrial Internet of Things (IIoT) solutions are going to surpass the consumer Internet of Things in the next five years. The main advantages of IIoT solutions in upstream operations are the low cost of supply, increased production and higher safety scores.

Among the main advantages in downstream operations are personalized service at the retail points, increased share of wallet and increased loyalty to the brand.

The opportunities in upstream are plenty, but I believe the major opportunity is in real-time resource optimization across the full upstream lifecycle.

Sergio Zazzera (ENI): The IIoT solutions are key components of the future technology recipes but they can even offer an effective and viable answer for old plants retrofitting, decreasing the gap between brown fields and green fields.

Main areas of technological investments in oil and gas

What are the key technologies which your company would like to implement in the next 5 years?

Predictive analytics will help forecast demand in the downstream area (Ricki Koinig, OMV)

Sharul A Rashid (Petronas): For us it’s mainly wireless technologies, fieldbus technologies, open system, yet secured technologies.

Sergio Zazzera (ENI): We are looking at edge computing with edge IoT gateways and smart sensors, machine learning and analytics, image recognition, wearable technology, augmented reality and additive printing.

Satyam Priyadarshy (Halliburton): The key technologies that the oil and gas industry overall needs to implement in the next five years are IoT sensors with a sensor-to-sensor communications network, wearable devices, smart analytics at the edge, based on Big Data and data science, cloud solutions, and augmented and virtual reality solutions.

Ricki Koinig (OMV): A main focus lies in predictive maintenance solutions utilizing sensor streaming data in conjunction with machine learning and artificial intelligence. Predictive analytics will also help forecast demand in the downstream area.

The need for a digitalization and transformation roadmap in oil and gas

Nothing works without a plan and if we look at the longer term roadmaps are needed. Do you think it is important for oil and gas companies to have their digital transformation strategy roadmap?

Sergio Zazzera (ENI): Nowadays the presence of a clear and defined roadmap for digitalization is mandatory for disclosing, unlocking and leveraging the potentialities that are inherent to the new digital wave in EACH company.

Ricki Koinig (OMV): A clear, simple, aligned and consistently visited roadmap tool is essential for common understanding and direction between all stakeholders – that includes business lines, finance, procurement, IT strategy and operations.

At OMV AG, we have redesigned and developed a method to analyze and map market trends and our business needs. Collaborative discussions on these mappings across the organization create a basis for agreed and aligned content in the digitalization roadmaps.

The subsequent roadmaps allow us to determine what technological, organizational and capability steps we need to take now as well as into the future. Our common roadmaps also allow us to see possible synergies across the organization and thus best coordinate planning and activities towards digitalization objectives.

Sharul A Rashid (Petronas): A definite YES.

Satyam Priyadarshy (Halliburton): I believe that a roadmap for digital transformation is critical for oil and gas companies.

More importantly, the roadmap needs to match the pace of technological evolutions, rather than being a five to ten years roadmap as in current practice.

The deployment of the Internet of Things in oil and gas: the challenges

Going back to the Industrial Internet of Things. What are the current challenges and hurdles that affect the spread and deployment of the Internet of Things in an oil and gas organization?

Sharul A Rashid (Petronas): Cybersecurity threats and the maturity of some of the technologies are certainly two of them.

Lack of data integration technologies and slow adoption of big data technologies to store and analyze collected data can slow information potential down (Ricki Koinig, OMV)

Sergio Zazzera (ENI): As mentioned before, IoT solutions are key technologies enabling completely new business models by interconnecting things and people and gathering huge quantities of data. Of course new menaces are rising and spreading: security has to be not only physical, since you have to protect the ‘soft’ side of plants, yards, equipment, etch from cyberattack threats.

Satyam Priyadarshy (Halliburton): There are many challenges regarding the adoption of IoT inside an oil and gas organization.

The top five challenges, according to me, are:

- readiness of IoT devices for the oil and gas environment which can range from rather friendly to extremely hard environments;

- the lack of standardization in how these IoT devices generate and share data;

- the lack of mature integrated data and information management platforms like the DecisionSpace™ platform;

- the lack of skilled talent; and

- leadership with regards to the adoption and deployment of IIoT.

Ricki Koinig (OMV): Technological constraints (e.g. availability and usability of explosion protected devices and sensors in hazardous areas) are clearly a health and safety priority.

Lack of data integration technologies and slow adoption of big data technologies to store and analyze collected data can also slow information potential down.

Organizational constraints such as restrictions on handling of personalized data, or general lack of trust in predictive models, and even missing capabilities in the areas of analytics, modelling and statistics are all current or potential challenge areas we are taking seriously.

The key role of (big) data, the edge and AI/ML in the oil and gas industry

As you could read, many experts in the interview point out the importance of analytics (at the edge), big data, and IoT. In the end, it all revolves around data and what you do with it.

The oil and gas sector is one of the most data-intensive industries that exists and has been depending on large volumes of data since long before current technologies since data have always been key to understand resource and production potential, as well as boost operational efficiencies at oil fields, reminds Anna Yarygina of Schneider Electric in a blog post.

The high volumes of data generated in the industry, require artificial intelligence and machine learning tools, which are also significant contributors to the growth of the global big data market in the oil and gas industry.

It’s clear that edge computing also plays an increasingly important role in oil and gas since the industry, by definition, already ‘lives’ on the edge with often hard to reach assets and operations.

With the push to enhance production, avoid production disruption and thus predict failure of equipment, and the role of environmental information in forecasting future production volumes, AI, ML, and big data have a further significant role to play in oil and gas.

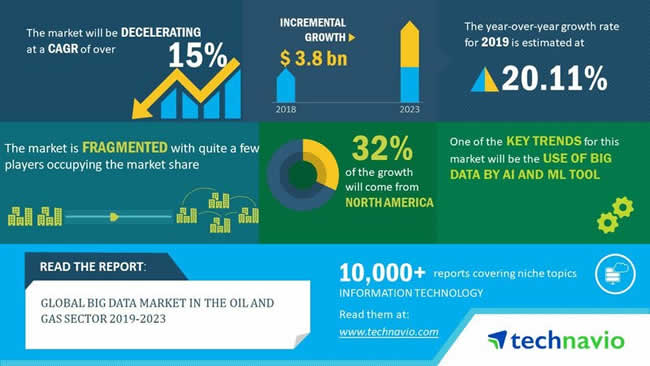

According to TechNavio, the global big data market in the oil and gas industry will grow with a CAGR of over 15 percent during the period 2019-2023.

Commenting on the findings of the report, a senior analyst summarizes some of the main concerns and priorities in the oil and gas industry -and the role of big data in it all:

“Apart from the use of AI and ML tools, environment and safety are among the prime areas of concerns for companies in the oil and gas sector. The presence of government regulations related to protection and safety is enforcing them to take effective measures. However, big data solutions enable enterprises to tackle this challenge efficiently. Vendors in the global big data market in the oil and gas sector are also offering different solutions to help enterprises to overcome health, safety, and environmental challenges, thereby driving market growth for the next few years”.

According to a report from Ernst & Young, 89 percent of oil and gas organizations intend to increase their digital investments with efficiency remaining the key driver after years of oil price volatility.

Robotic process automation (RPA) and advanced analytics are expected to have the most significant impact on the industry over the next five years — both cited by 25% of executives, respectively.

As Anna Yarygina, finally, reminds the growing pressure from investors and stakeholders on oil and gas companies to reduce their environmental impact and to demonstrate their long-term business viability pushed them to start investing in their own energy transition.

Top image: Shutterstock – Copyright: Travel mania – All other images are the property of their respective mentioned owners.