Internet of Things platforms are essential for IoT deployments. Despite being a relatively young market, the IoT platform market is and has been going through significant shifts with literally hundreds of providers adapting their strategies to changing customer requirements for IoT platforms and to evolving technological realities.

IoT platforms have become an essential part of the IoT stack. They find their roots in, among others, the need to manage, monitor, store, secure and analyze IoT data (with a growing role for artificial intelligence), the enablement of applications (with a growing focus on vertical applications and open source), IoT device management, the lack of standards and interoperability with related gaps in a broader IoT perspective whereby they serve as a bridge to close those gaps as Nicolas Windpassinger explains in his IoT book, and the tackling of several IoT roadblocks.

In other words: IoT platforms integrate several capabilities and features into a solution, essentially enabling to deploy IoT projects and develop applications in a better, faster, more cost-efficient and integrated way, at the same time serving as a bridge, middleware and solution to overcome IoT issues in enabling these applications and ultimately outcomes.

What are IoT platforms really? Application enablement and beyond

IoT platforms essentially reside in-between the device and data level and the application, use case, user and business outcome level.

They play a role in security and need to be scalable and flexible to respond to customer needs, use case demands and goals which of course vary a lot, depending on use case, vertical and so forth as we’ll see.

In the strict sense an IoT platform is an IoT Application Enablement Platform or AEP. Application enablement platform (AEP) vendors have a technology-centric offering with the goal to deliver an industry-agnostic and extensive middleware core to buildin a set of interconnected or independent IoT solutions, MachNation says, while platform-enabled solutions (PES) are solution-centric and aim for fast end-to-end vertical IoT solutions.

Early 2018 MachNation stated that enterprises prefer to buy cloud-based offerings from best-in-class AEP vendors rather than building their own platforms.

In his previously mentioned book, Nicolas Windpassinger defines an AEP as a form of platform-as-a-service meant to enable a developer to rapidly deploy an IoT application or service without worrying about scale-out or scale-up factor.

The difference between IoT platforms and traditional M2M platforms according to him are that IoT platforms have specific IoT capabilities such as application development, application management, scalability on top of more traditional M2M platforms capabilities such as carrier and communications integrations, device management and operation environment.

When covering some Gartner IoT technology forecasts in 2016 we mentioned that the company sees IoT platforms as bundling many of the infrastructure components of an IoT system into a single product. That much is clear.

More interesting was the distinction of the services which are offered by IoT platforms in 3 big categories (we quote):

- low-level device control and operations such as communications, device monitoring and management, security, and firmware updates;

- IoT data acquisition, transformation and management; and

- IoT application development, including event-driven logic, application programming, visualization, analytics and adapters to connect to enterprise systems.

So, IoT platforms indeed fulfil many potential goals: fast development of IoT applications, connecting the backend and the device ecosystem, IoT device management, data collection and integration, you name it.

What’s the most important of all, however, is that IoT platforms are needed to build applications and leverage all this IoT data for business purposes and that encompasses a lot of possible functions indeed.

Shifting buyer and vendor approaches in the IoT platform ecosystem

Let’s take a look at how demands – and thus also offerings – regarding IoT platforms are changing and continue to change.

The requirements are obviously related with the goals of the buyer who is in the market for an IoT platform. On a business level those needs revolve around the IoT use cases and the sought benefits from a user and application perspective.

It’s clear that within specific areas where IoT plays an important and increasing role, from Industrial IoT (where we find IoT and IIoT edge platforms) to smart cities (smart city IoT platforms) and other verticals, or even in verticals within those verticals (e.g. smart buildings), these use cases tend to be similar, leading several vendors to focus on platforms within one or more of these verticals and specialize within a specific niche.

On top of that organizations – and thus buyers of IoT platforms – of course don’t stick to just one or a few use cases as they continue to leverage IoT in a gradual way, whereby roadmaps further evolve and include more use cases and applications which need to be connected. This de facto leads to a market demand for agile, open, future-proof and scalable IoT platforms.

It is safe to say that strategic priorities of IoT platform buyers define the directions in which these platforms develop and that buyers most certainly look at the architecture and future roadmaps, as well as the depth of knowledge and support of vendors regarding their particular industries and verticals, when taking decisions.

This also includes the partner ecosystems of IoT platform vendors as it’s not just about the solution and its features and IoT deployments de facto involve several partners. Such partnerships are not just about partners in the strict sense but also about partnerships that matter within the specific vertical on levels such as security, standards and even associations of companies and other organizations, including standardization and interoperability bodies, within that specific vertical.

It indeed is an entirely different story than just one of features, possibilities and performance of IoT platforms whereby one should make sure to clearly understand what exactly market researchers mean with an IoT platform and within which vertical, set of capabilities and context they conclude that IoT platforms x, y and z are the best IoT platforms in the market.

As the consultant tends to say when asked what solution is the best, the answer is ‘it depends’. It’s clear that when looking at those lists of ‘best IoT platforms’ one definitely should be taking into account these crucial roadmaps and the vendor’s strategy in terms of openness, scalability, security, strength/stability, potentially support of specific regulatory requirements, viability and good old pricing strategy. Concerning the latter: given the gradual deployment of IoT in many organizations in practice many buyers do look at dynamic pay-as-you-go pricing models as well, enabling them to have a platform that grows with their needs. It is not surprising that the interest in open source IoT platforms is growing as MachNation already found in 2016 and as smart city IoT platform research from ABI Research found in March 2018.

IoT platforms: market and business evolutions as more technologies get integrated into IoT deployments

Making it even more complex are the evolutions within IoT technologies and related technologies that are evolving rapidly.

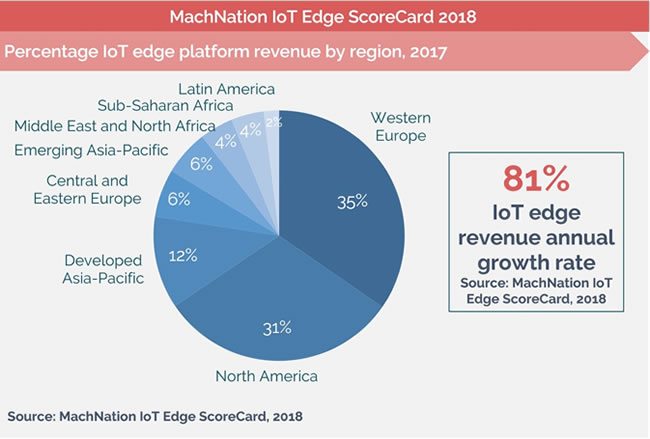

Artificial intelligence and machine learning, edge computing (whereby overall IoT edge platform revenue is poised to grow significantly according to MachNation since roughly 90 percent of edge complexity is software related as CTO Dima Tokar put it end 2017), the ongoing disappearing of silos in specific verticals whereby platforms inevitably evolve as IoT is key in the convergence of functions across more applications within and even beyond the vertical, digital twins and blockchain are just a few of these evolutions.

Most obviously also in the market of Industrial IoT platforms the role of AI engines and cognitive capabilities is growing as organizations want to realize smarter and more advanced use cases while vendors seek to increase solution performance.

The IoT platform market isn’t just big from a vendor perspective, it’s also growing, consolidating and complex as all vendors have their particular strategies which they deem to correspond best with ongoing evolutions, customer demands and needs, their own revenues and so forth.

The stakes for vendors are high. According to a 2018 IoT spending update from IDC the segment of IoT software will be the fastest growing of all IoT segments (hardware, software and services) with a five-year CAGR of 16.1 percent. Services spending follows next from a growth rate perspective but is bigger and will close to be equal to hardware spending by the end of the five-year forecast.

Within software application software leads along with analytics software, IoT platforms, and security software. Keeping in mind what we said about the importance of definitions, IDC’s definition of an IoT platform: ‘an IoT platform is a commercial software product that offers some combination of the following capabilities: management of IoT endpoints and connectivity; access, ingestion, and processing of IoT data; visualization and analysis of IoT data; and IoT application development and integration tools’.

This IoT platform definition, which IDC mentioned at the occasion of an IDC MarketScape evaluation of IoT platform providers in January 2018 with a focus “on the strategies of vendors that have strength in the connectivity layer of the platform and are building additional application enablement services upon that connectivity layer” (or in other words: vendors that “provide cellular connectivity management and/or other capabilities such as device management for the Internet of Things”), is just one of many IoT platform definitions and it’s clear that in the past, present and future roadmaps of IoT platform vendors the other mentioned categories of software are more or less integrated.

Moreover, IoT software, IoT services and even IoT hardware are often combined in the different approaches of vendors, with IoT platforms and software as a way to sell the rest, often where those partnerships and ecosystems come in (few sell it all).

IoT platforms: focus on business and outcomes with IoT business platforms

Especially the combination of IoT software and services matters here as that is where the biggest chunk of revenues will be but of course also because that is in the end where the difference is made from the customer perspective in this age where software eats the world and deploying the right solutions at the right time for the right purposes is the crux of the matter.

It is nothing more than a logical evolution as the usage of IoT, in combination with other technologies, matures and the focus increasingly shifts from the levels of connectivity and connected devices to edge applications, the platforms enabling the solutions within several use cases and the services upon which these solutions rely.

IoT is not just about sensors or the lower levels of the IoT stack, it’s about data analytics and ‘intelligent’ information within interactions, transactions, innovative applications, decisions and, ultimately, myriad benefits across various use cases for the sake of organizations, their customers (or citizens, patients and so forth) and other stakeholders.

And the focus on verticals (and business) will definitely remain one of the crucial ways to go for many players. Or, as Navigant Research analyst Neil Strother put it in a press release on an IoT platform Leaderboard report update end 2017, IoT platform vendors with innovative and differentiated products that become standard across a particular industrial sector, or sectors, will have the market advantage.

The more vertical and business-focused approach in IoT platforms (on top of the big horizontal ones which focus on the depth and width of functionality or specific areas such as connectivity and carrier integration) also shows in the types of IoT platforms.

On top of connectivity platforms and the mentioned application enablement platforms (AEPs) or integration platforms, ‘Digitize or Die‘ author Nicolas Windpassinger emphasizes a third type as we see it: the vertical and horizontal BUSINESS platforms and applications.

Given the current state of standardization, interoperability and myriad technologies on all levels (including communications) it’s normal that the focus is still a lot on the more foundational levels but one day in IoT too the hardware and connectivity will be a matter of innovations and improvements, yet with far less attention for these enabling layers that will be relatively invisible, just as networks, storage and so forth are today in IT: essential to make it all work but not the core focus as organizations simply want to look at the outcomes which is why the role of IT has been changing to begin with.

And keeping that quote (mentioned above) from Josef Brunner, CEO of relayr, in mind from Windpassinger’s book: IoT platforms are about use cases and user benefits.

Top image: Shutterstock – Copyright: StanislauV – All other images are the property of their respective mentioned owners.