Previously we looked at the evolutions in the cellular IoT gateway market until 2023 (with data on shipments and on the various vendors in 2017) according to an October 2018 report by Berg Insight.

On top of company profiles and data concerning the cellular IoT gateway market the report also contains updated profiles of ten cellular IoT module vendors with, again, data on the market in 2017, an overview of the market drivers and predictions on shipments and sales. While China played a key role in 2017 the new cellular IoT LPWAN standards (3GPP release 13) are poised to become key drivers, along with LTE Cat 1 Berg Insight states. A deeper dive.

The cellular IoT module market is less fragmented than the gateway market Berg Insight points out and in its press/news section the research firm provides some more findings.

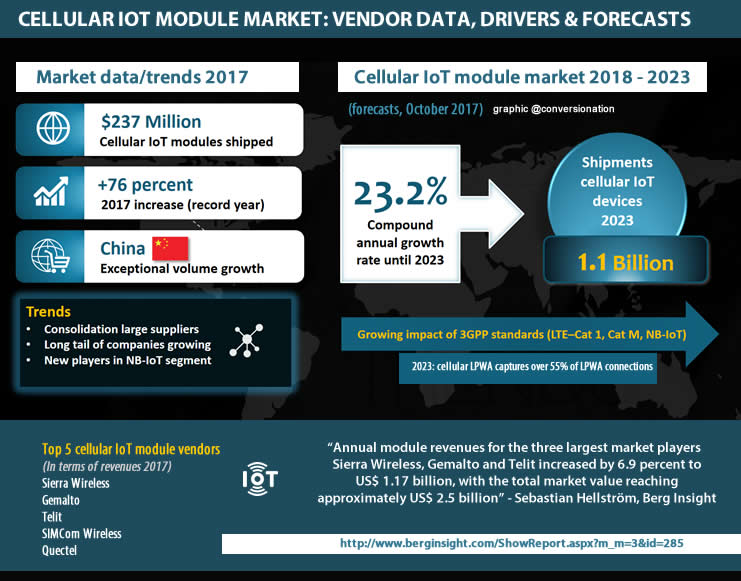

According to Berg Insight global cellular IoT module shipments increased by 76 percent in 2017 to a new record level of 237 million. The main driver: exceptional volume growth in China. In the forecast period cellular IoT device shipments are expected to grow at a CAGR of 23.2 percent. By 2023 the market should thus reach about 1.1 billion shipped units.

The growing role of the new 3GPP standards in the cellular IoT module market

In this period the role of those 3GPP standards will be significant. One of those standards is NB-IoT which is being rolled out in several countries, with different approaches (e.g. Vodafone in the Czech Republic, Germany, Greece, Ireland, Italy, Australia, Netherlands, South Africa, Spain and Turkey, Orange in among others Belgium where the company finalized its LTE-M and NB-IoT coverage this year, AT&T in the US and Mexico, Deutsche Telekom in Germany, etc.). The other 3GPP standards that are expected to boost the cellular IoT device market are LTE–Cat 1 and Cat M.

When and where which 3GPP cellular IoT standard will gain the most market share is still food for speculation. The many wireless IoT standards have their place and use cases and it’s no different for LPWA standards. According to the previously tackled ABI Research Low-Power Wide Area Network Market Data report non-cellular LPWA (the likes of LoRa and Sigfox) would cede market share dominance to NB-IoT and LTE-M by 2023. That’s indeed the year ending the forecast period of the Berg Insight cellular IoT module forecasts. Looking at current evolutions it’s likely that some forecasts regarding 3GPP standards will be revised though as the roll-outs are slower than expected, among many other reasons such as relatively high costs and the state of networks.

Nevertheless, for Berg Insight it’s clear: “The 3GPP standards for LTE–Cat 1, Cat M, and NB-IoT – will contribute substantially to growth in the next coming five years”. The company describes these 3GPP standards as being “designed to be less complex to limit power consumption and priced more favorably to address the mass market and make it viable to connect entirely new applications”.

Cellular IoT module market dynamics: the big players, the long tail and the new vendors in the NB-IoT segment

Back to the cellular IoT module market. According to the Berg Insight report the three largest vendors (Sierra Wireless, Gemalto and Telit) have 46 percent of the market in terms of revenues (data 2017).

The number one in terms of cellular IoT module shipments is SIMCom Wireless, which ranks fourth in terms of revenues. Quectel is number two in terms of volumes and in fifth place in terms of revenues.

Berg Insight IoT Analyst Sebastian Hellström comments: “Annual module revenues for the three largest market players Sierra Wireless, Gemalto and Telit increased by 6.9 percent to US$ 1.17 billion, with the total market value reaching approximately US$ 2.5 billion”.

In further comments on the cellular IoT module market evolutions Berg Insight points out that China has been the scene for significant M&A activity in the past years. “ZTE offloaded its cellular IoT business to Gosuncn during 2016 and 2017. At the same time, Sunsea AIoT emerged as a new major industry player through the acquisitions of Longsung and SIMCom”. On a sidenote: China is also where 3GPP network rollout has been and is highest.

However, while there has been some consolidation among the larger suppliers, the long tail of companies with activities in the market for cellular IoT modules is growing, Berg Insight continues.

Here as well NB-IoT plays a role. Berg Insight: “A number of new players have been attracted to the market, particularly in the emerging NB-IoT segment. Examples include Nordic Semiconductor, Foxconn and WNC”.