The Industry 4.0 market is poised to grow significantly. The increasing adoption of IoT in the digital transformation of manufacturing and related industries, the rise of industrial robotics and the proportionally higher spend in the Industrial Internet of Things are just some contributing factors.

Obviously Industry 4.0 isn’t just a matter of technological factors. While we are still in the early days of Industry 4.0 and challenges remain on many fronts such as the integration of IT and OT, data capabilities, implementation challenges, guidelines and strategic capacities, skills, culture, standards and the maturity/readiness levels on the path from sheer optimization/automation to real transformation, Industry 4.0 is also driven by myriad challenges in the supply chain and customer expectations.

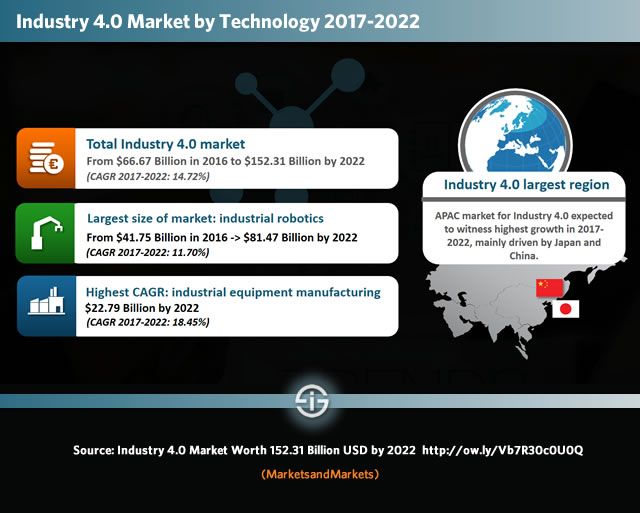

The Industry 4.0 technology market is forecasted to reach $152.31 Billion by 2022

In an ongoing quest to deliver the value of Industry 4.0, it is certainly also boosted by national and supra-national pushes in a changing geopolitical industrial ecosystem, further driven by some of the larger players and alliances in the industry.

Industry 4.0 technology spending: growth at a CAGR of 14.72 percent between 2017 and 2022

It’s interesting to take a look at the key evolutions, drivers and areas of spending in the digital transformation of manufacturing, which Industry 4.0 ultimately is.

We tackled many of them previously, a report announced by MarketsandMarkets on May 22nd 2017, adds to it. An overview and analysis with additional findings from McKinsey and IDC.

By 2022 industrial robotics will hold the largest size of the Industry 4.0 market

The MarketsandMarkets report looks at the evolutions and growth of the Industry 4.0 market by technology, hence the focus on technologies in the introduction. The technologies covered by the report are:

- Industrial Robotics (the biggest share).

- IoT (in this case Industrial IoT).

- Cybersecurity (a clear concern in manufacturing and Industry 4.0 too as reported previously with regards to industrial cybersecurity).

- 3D Printing (we’re not sure if it’s only 3D Printing or additive manufacturing, including 3D Printing though).

- Advanced Human-Machine Interfaces.

- Big Data (including of course analytics).

- Artificial intelligence (paramount in most of the other components).

- Augmented Reality (AR) & Virtual Reality (VR), whereby you can include digital twins.

Looking at the total spending predictions of the report we see that the Industry 4.0 market, from the mentioned technology spend perspective, is expected to reach $152.31 Billion by 2022.

In 2016 the overall market was valued at 66.67 Billion USD, the press release states. Between 2017 and 2022 the forecasted Compound Annual Growth Rate (CAGR) reaches a double-digit percentage of 14.72 percent.

The dominant position of the APAC region and China – with some caveats

Interestingly, the major growth markets, according to the report, are not the US (where Industry 4.0 could give a boost to industrial productivity but has very specific challenges) or Western-Europe, and this despite a gradual awareness of the importance of the Industry 4.0 vision in the UK and important initiatives in the EU to align and promote Industry 4.0 initiatives as they exist in various member states.

As a reminder: the ‘concept’ and term Industry 4.0 stems from the German industry and has been developing along with initiatives in other countries, including the US where the ‘idea’ of the Industrial Internet was ‘born’.

China leads the Industry 4.0 technology market, yet – for now – the country lacks the culture and non-technological success factors for the transformation of manufacturing

The honor of the fastest growing Industry 4.0 market is for the APAC region in the forecasted period with the major contributors to this growth being China and Japan.

Made in China 2025: is technology investment enough?

China’s response to Industry 4.0, “Made in China 2025”, was launched a few years ago and has been focusing on an international approach with vendors going to events in Bejing, the hub of China’s industrial transformation and “Made in China 2025” pavilions at events such as Industry 4.0 annual gathering Hannover Messe.

Moreover, China has been actively acquiring Industry 4.0 firms to become the global center of smart manufacturing. The country, just like Japan, faces a rapidly aging population and thus gradually loses its benefits of cheap labor, making it keen to innovate. Whether it will succeed is still an open question though. According to IDC, manufacturing IT spending in the APeJ region (APAC without Japan) is poised to reach US$ 36 billion by 2020 with an important role for China, India and the ASEAN countries and Industry 4.0 and Made in China 2025 as a key driver.

However, as the South China Morning Post wrote, based upon McKinsey findings, Chinese manufacturers are not well prepared for Industry 4.0, including the non-technological aspects that are key for any successful transformation, from culture to skills.

Yet, according to the report from MarketsandMarkets, among others the higher adoption of robotics in China, Japan and also South Korea is a key factor from an Industry 4.0 share perspective, with the understanding that we’re only talking technology here.

In April 2017, IDC forecasted that China will continue to lead worldwide robotics adoption (consumers, healthcare etc. included), “with discrete and process manufacturing accounting for over 50% of spending in 2016” and further strong growth in cross-industry applications and process manufacturing.

Japan and a note on the APAC robot market

Japan is a somewhat different story as the country has other experience with regards to transformation and even goes for an approach, Society 5.0, that goes way beyond Industry 4.0. Japan also by fear leads the global list of aging populations.

A final note on robotics and the APAC region: according to IDC, spending on robotics overall will reach $133 Billion in 2020 across the region, including Japan, where robots in general are already pretty present. By way of comparison: global robotics spending is expected to reach $188 Billion in 2020, clearly showing how the region is the regional market.

Industrial robotics and industrial equipment manufacturing poised to lead Industry 4.0 technology spend

Back to the technologies. According to the research, by 2022 industrial robotics will hold the largest size of the Industry 4.0 market. Key reasons: the impact on productivity, reduction of human errors and higher production volume.

The total industrial robotics market is expected to reach $81.47 by 2022, at a CAGR of 11.70 percent the press release states. Important drivers from a vertical perspective: automotive manufacturers and OEMs.

The market for industrial equipment vertical is expected to be valued at $22.79 billion by 2022, growing at the highest CAGR of 18.45%

Although industrial robotics will hold the largest share, the fastest growth until 2022, however, is for the market for industrial equipment with a CAGR of 18.45 percent and with a strong focus on predictive maintenance.

According to the report announcement, predictive maintenance capabilities will help the industrial equipment manufacturing industry to save up to 50% on their maintenance cost.

Top image: Shutterstock – Copyright: Zapp2Photo – All other images are the property of their respective mentioned owners.