In the 2016 World Retail Banking Report, Capgemini and Efma, offered an overview of the drivers and evolutions regarding FinTech.

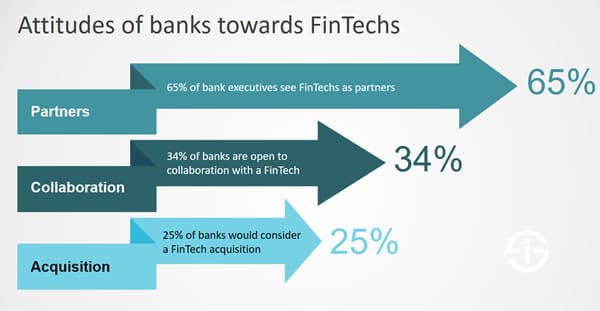

Among the key takeaways from that report: a majority of consumers already use FinTech products or services, they are highly likely to recommend them to their peers and a majority of banking executives see FinTech companies as partners.

World FinTech Report 2017: the reality of increasing bank and FinTech collaboration

This rather collaborative approach was seen in many FinTech segments during 2016 and was also reported in an e-book by IDC, released in September 2016.

Based upon the market evolutions, the World Retail Banking Report 2016, the IDC report and industry sources we mentioned how digital transformation challenges of banks would lead to not just more partnerships in 2017 but also to acquisitions and several forms of collaboration across the globe, with a potential exception for (parts of) Europe.

FinTechs (and start-ups) are great resources to partner with and in the last 12 months we have partnered with, acquired, or licensed over 10 FinTech companies (Neal Cross, Chief Innovation Officer, DBS Bank)

Early November 2016, Capgemini, in collaboration with Efma and LinkedIn, took a deeper dive in the FinTech evolutions and introduced the World FinTech Report 2017.

The report confirms that FinTechs are being increasingly adopted by financial services customers, mainly younger and tech-savvy customers. And it also looks at innovation challenges among banks and how FinTechs play a role in overcoming them.

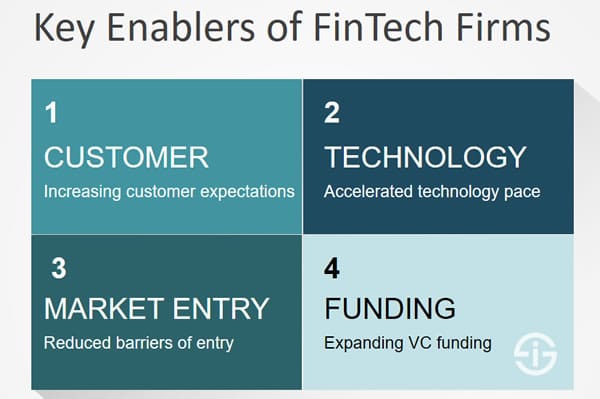

Customer expectations and the accelerated pace of technological evolutions

One of the key reasons why FinTechs have grown in popularity is the long standing challenge for banks and financial services providers to be able to meet increased customer expectations and respond to the customer experience spill-over effect, whereby consumers expect the same levels of service and experiences from banks and other firms as they are used to get them from leaders in customer experience.

Many banks have understood that working with FinTechs is one way to deal with this challenge and with other drivers of the rise of FinTech such as the accelerated pace of technological evolutions. They understand the drivers of Fintechs, as depicted below, and also realize that customer experience and innovation are crucial, which in several cases leads them to collaborate with FinTechs or develop new approaches themselves, as the World FinTech Report 2017 confirms.

How banks collaborate with FinTechs: the DBS Bank example

However, coming up with new approaches isn’t that easy for banks. The World FinTech Report 2017 states that traditional financial services providers are “struggling to apply innovative and FinTech-like capabilities to achieve tangible results.”

It’s just one of the reasons why many banks and other financial services providers look to work with FinTechs to innovate better and faster, although others have different approaches.

A bank that has been very active in collaborations with FinTechs is DBS Bank. In a video which is released at the occasion of the World FinTech Report 2017, Chief Innovation Officer Neal Cross weighs in. Apparently, in the last twelve months alone, DBS Bank has “partnered with, acquired, or licensed over 10 Fintech companies”.

FinTechs have customer experience challenges too

This doesn’t mean that FinTechs are the answer to all innovation and customer-facing challenges that banks have of course. That would be too easy.

The World FinTech Report 2017, for instance, also found that traditional players, as well as FinTechs, have difficulties to meet (changed) customer expectations. This is especially the case during the most important “Moments of Truth”. We’ve mentioned the customer experience and expectations struggles of FinTechs before and dive deeper into the topic in a next post.

You can download the World FinTech Report 2017

Top picture: purchased on Shutterstock. Copyright: one photo. All other pictures: see mentioned owners in image description and links.