It’s been some time since we looked at digital banking, and more specifically digital transformation in the retail banking industry. As we’re working on our 2018 lists, an updated version is on the way.

This article by Konstantin Didur, senior marketing manager at software development company N-iX, dives deeper into an actual way to realize digital transformation in banking, especially in community banking and in regional banks.

The article offers a digital banking transformation roadmap and framework with a way to effectively realize a digitalization of banking processes with a focus on, among others, mobile, cloud, user experience, data analytics, chatbots, mobile wallets, self-service and front-end and back-office integration with APIs. Although the approach is mainly aimed at projects for community banks we’re convinced that it also contains valuable information for large banks, developers and digital banking strategists.

The spending spree of the big banks

Match borrowers with lenders directly and there is no need for intermediaries anymore (editor’s note: also think how blockchain is poised to play a role here). So when digital disruptors squeezed their way into financial services industry, one could think banks were doomed.

Nimble financial technology companies (fintechs) are luring customers away with better online service, lower fees, and cheaper transfers. Consider a huge cost of digital transformation for banking corporations and you see legacy players can have a hard time catching up with the newcomers.

Apparently, the banks were not going to simply give up. Over the last five years, they spent tens of billions of dollars setting up innovation hubs, buying competitors, and changing operations (editor’s note: more in the N-iX report Leaders spend billions on Digital Transformation. How to keep up?)

Deutsche Bank is one of the great digital transformation examples in banking. The bank established an R&D center with over 400 developers and brought in several vendors to enhance its digital capabilities. But Deutsche Bank is a global company with hundreds of billions in assets, and the media generally focuses on the “big guys”.

What about regional and community banks?

When it comes to digital capabilities, most of them played the waiting game. As a result, the majority of community banks find themselves losing out on both ends:

- Large banks threw billions of dollars to become sustainable digital players.

- Fintech startups brought the innovative financial technology to the table in the first place.

- Small banks have none of those advantages.

They find themselves squeezed between global banks with deep pockets and agile fintechs.

Moreover, technological innovation is extremely challenging and costly for the community and regional banks. Switching to digital rails often gets prohibitively expensive – they simply cannot afford to bet a fortune on transformational initiatives. After all, around 80% of digital transformations fail.

This post offers a way out for community banks. A strategy of digital transformation in banking with a reasonable budget and clear achievable results.

Digital banking transformation roadmap for community banks

It’s not all bad news for community banks. Studies show they are actually better at banking than the big guys. It is also possible that the regulatory climate will change in their favor in the near future.

Small banks also have distinct advantages over fintechs, e.g. diversified services, established brands, loyal customer base, community support, focus on security, and more. They just need to utilize these strengths in the new digital environment.

Community banks can’t throw the money around but they can play a smarter game. This calls for a cautious and actionable approach to banking digital strategy. A plan with clear stages that allows a bank to transform on a relatively low budget. Let’s call it:

Start small, Add platforms, Scale success

This cautious strategy allows to transform a bank in iterations focusing on process automation. Here is the roadmap:

A community banking digitalization approach in 3 stages

Stage 1: Start small

Clients call for zero human interactions. They don’t want to wait in queues and go to the branch to carry out every transaction. Wasting 30-60 minutes just to check the balance or perform other routine operations is extremely frustrating, especially for the millennials.

Interestingly, even SME and corporate clients often spend hours in queues each month. Small businesses pay banks huge transaction fees, so they, too, require fast and convenient service. A mobile application can cover a large chunk of the routine workload and is a viable solution for retail and business customers alike.

Therefore, start by automating user-bank interactions. Focus on the most important functionality for modern consumers – mobile experience.

Create a fast and secure mobile platform and a customer-facing app with intuitive UX. It will allow users to perform the most popular operations from their device. Just up to 12 actions, e.g. check balance, order transaction statement, pay the bill, etc. That’s it.

Over 60% of bank customers aged 18-44 use mobile banking and the number is steadily growing, a study by Federal Reserve claims (PDF opens). That is one of the most sought by digital capabilities, but the majority of small- to midsize retail banks lack good mobile experience.

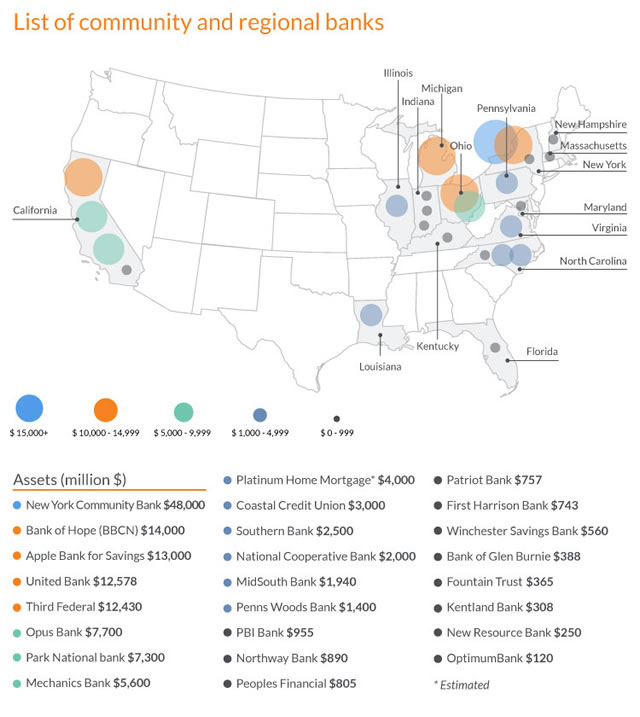

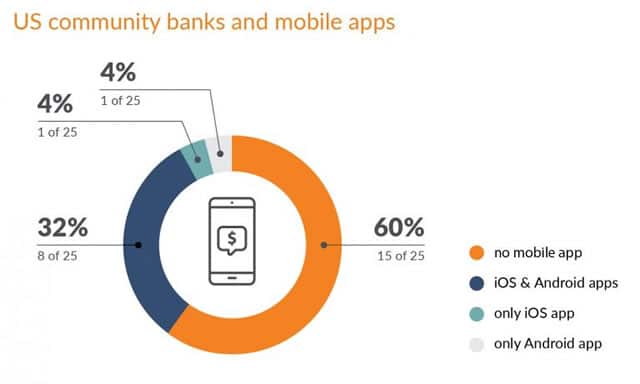

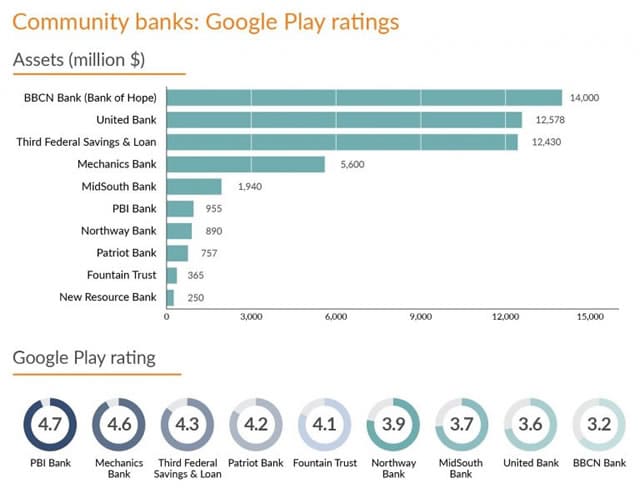

We’ve analyzed 25 US community banks to understand how well users rate their mobile apps. Here’s the list:

The findings are quite intriguing. It turns out, only 10 out of 25 banks have some mobile application.

Here is the breakdown:

5 out of 10 analyzed apps have Google Play rating 3.9 or less:

Therefore, as of September 2017, 80% of the analyzed banks have no mobile app or a weakly performing one.

Simply providing a decent mobile banking app will help them automate routine customer interactions and greatly enhance their digital capabilities.

Workflow

We saw several high-profile banking digital transformations in 2017, e.g. Deutsche Bank, ABN Amro, and the likes.

Compared to these full-scale campaigns, launching a robust mobile platform seems like a relatively trivial project. If outsourced, it can be set up and implemented within several months and with a reasonable budget.

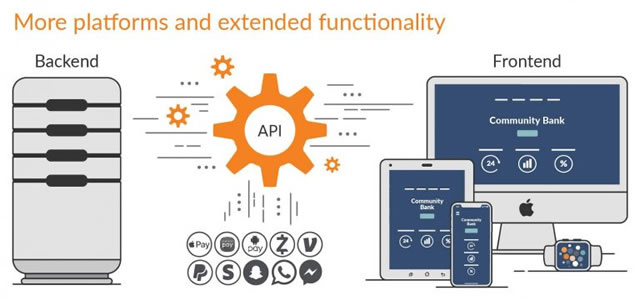

What’s more, retail banks can start mobile platform development right away without the need to change their internal processes. In this scenario, a bank uses an open API to connect its existing legacy architecture with a newly created mobile application. The system simply extracts data from the backend and presents it to the user through an app.

At the “Start small” stage, a bank can implement further changes that will not require dramatic redesign of the internal processes. The solutions here include video tellers and self-service kiosks at the branches as well as automation of some existing back-office operations.

Here are the key features of the first transformational stage:

- Launch a secure mobile app with great UX. It gives clients a convenient access point to all key financial transactions eliminating the need to visit the branch.

- Start with a single application (e.g. iOS)built in compliance with all existing regulations. A robust and secure system with ultimate data consistency. Two-factor or multi-factor authentication with Touch ID or Face ID. On-premise solutions for the key functionality and possibly cloud-based for the supporting tasks.

- Add self-service points at the branches. Automated kiosks decrease hours of teller operation and require less staffing. This feature is critical for retail customers and SMEs alike.

- Automate some back and middle office tasks without changing existing processes.

Implementation

It is hardly possible for a bank to develop a sophisticated mobile platform in-house. Luckily, there are digital vendors, vastly experienced in the financial sector.

They build fast, secure, and robust solutions for all popular platforms, including web, iOS, and Android. Suitable vendors are already familiar with the security, compliance, and further requirements of such development.

Offshoring and nearshoring are viable options as well, as they can mean further cost reduction. Notable vendors that create solutions for financial service industry are in the Czech Republic, Romania, Estonia, Poland, and Ukraine. For North American and European banks, outsourcing to these countries offers 25-50% cost savings without compromising quality.

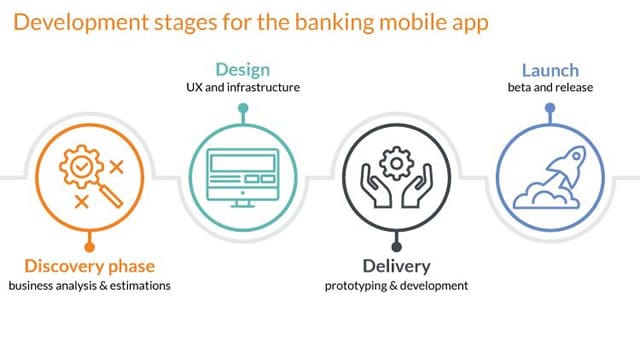

Implementation phases usually look as follows:

Once you have an up-and-running mobile app, you can build up its capabilities and add support for new platforms.

Stage 2: Add platforms

With the first platform up and running, you can port it to other platforms and devices. You can already use data analytics to boost client mobile service and increase customer engagement. At this stage, you can analyze how users behave with the app to make tailored offers.

A mobile platform also offers many integration possibilities ranging from the highly sought (PDF opens) reward programs and mobile wallets to digital payments and chatbots.

Workflow

Analyze user behavior to improve your app and support more devices:

- Polish application UX.

- Add further platforms and devices, e.g. web, Android, Apple Watch, Alexa, etc.

- Analyze user journeys to draw conclusions and anticipate customer needs.

Extend app functionality:

- Add mobile wallets, contactless payments, mobile check deposits, and more.

- Add other services: credit card points, retail discounts, cash-backs, rebates, and more.

- Add digital payments like PayPal, Venmo, Zelle, or Stripe.

- Extend app functionality with fintech solutions, e.g. MultiBanking, personal finance advisory, etc.

- Add chatbots for Facebook Messenger, WhatsApp, Snapchat, and other messengers. 80% of all client inquiries are outright straightforward and you can easily automate them with chatbots. There are ready-to-use solutions and you can seamlessly integrate them with the banking app.

Stage 3: Scale success

Merely adding an app to an AppStore is not a complete banking digital transformation. There is no way a legacy bank can successfully launch an innovation digital banking strategy without changing its internal processes. Hence, a mobile platform should be an inception point, not the final destination.

The next step is to introduce a new backend system and to remodel the underlying processes.

Some community banks might want to skip that stage, as it requires a thorough redesign of the operations. However, there are two important implications to consider:

- First, legacy banks face rising transaction costs and a decline in teller transactions. Process reorganization addresses both of these issues simultaneously.

- Second, sticking with the old backend can jeopardize future improvements of the mobile application. Just look at how quickly technologies evolve. Fail to change the legacy system, and any significant app upgrades will be impossible within two to three years after its launch.

This stage is the most challenging part of the digital innovation in the banking sector. Banks are generally pretty clunky, so the resistance to change inside the organization is usually the biggest issue.

This calls for a huge effort from the management to fully back the transformation and properly communicate all coming changes. More on the importance of top management involvement in the transformational initiatives in the previously mentioned white paper by N-iX.

Luckily, as long as the app proves its worthiness, it is easy to demonstrate how digital technologies bring value to the bank and its employees. It should be a strong point in pushing for further changes.

Workflow

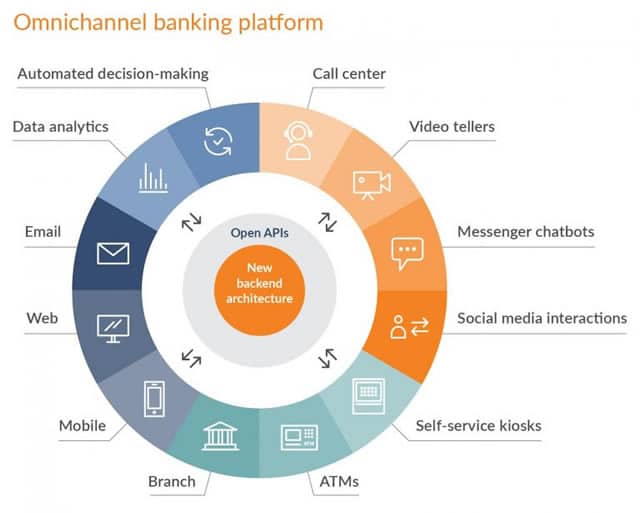

When a bank already has a fully functional mobile app, it’s time to change the backend system and to redesign the underlining processes. After that, newly created core systems can be connected to an existing mobile application with APIs.

The new infrastructure will greatly boost the functionality of the mobile platform.

At the third stage of digital transformation, a bank can pursue one of the two options:

- A multichannel system is a cheaper alternative that fits well into small bank’s constraints. On the downside, it is still siloed and can have scalability issues.

- An omnichannel platform offers several advantages such as tailored marketing, better tracking of the customer touchpoints, and more. Still, this is a more expensive alternative and its implementation requires more effort from the team. Omnichannel and the underlying microservices backend infrastructure have made a lot of buzz lately, but they often get extremely challenging to implement. This article on ZDNet gives more details on the matter.

Irrespective of the path chosen, the development phase still implies the upgrade of the system. Here are the key features of the final stage:

- Create backend platform and link it to existing mobile and web applications.

- Redesign back and middle office operations to support the new IT infrastructure.

- Integrate machine learning to boost cybersecurity and automate data analytics.

- Deeper collaborate with fintechs to create unique selling propositions.

Drivers for success

Start by finding a suitable vendor

Make sure your solutions provider has proven experience in fast, secure, and scalable apps and can choose the best tech stack for the project.

Next to cross-platform mobile development, the vendor has to be fully familiar with the financial services industry including compliance and strict security regulations. Domain knowledge is also essential for handling common financial technology development issues such as the logic behind financial operations, ultimate data consistency, and the high load.

The following project functions can be outsourced:

- Business analysts

- Software designers

- Project managers

- UI/UX designers

- Software programmers

- Quality assurance

Launching a decent mobile application requires a lot of effort from the bank’s team, too. The CTO and the head of the customer experience department have to be fully involved in the project. This way you can make sure the application fully matches your customers’ expectations and your backend capabilities.

Keep employees informed about the changes

Fear, uncertainty, and opposition accompany any change initiative. Still, when people are badly informed, the resistance can get really ugly.

Communicate the transformation is essential for the bank to survive. Assure people that the change will not happen overnight. They will have plenty of time to accommodate to the reorganization.

Strategy pros and cons

For most of the 6,000+ banks in the US alone, this seems like the most viable digital transformation banking strategy. Why?

It is cost-effective, evolutionary, and scalable.

The price of implementing such strategy is the lowest compared to other alternatives. Global financial organizations have huge resources they can allocate to change their operations, but most banks in the world are relatively small. Given these limited capabilities, a “discount” transformational strategy is the way to go.

This strategy also fits well into the risk-averse culture of the community banks. Small financial institutions are slow on picking up digital trends because they fear it is just “another stylish thing”. Starting with something that has already proven its worthiness for other banks (mobile platform) should convince the opponents of the change.

Once the mobile platform starts bringing value to the bank, pushing for further changes should become easier.

Pros

- Cost effective digital transformation.

- Low risk: the investment is spread over a longer period.

- At the early stages, no need to change internal processes dramatically.

- Each stage of the strategy is an autonomous digital transformation.

- Moderate employee resistance due to the slower pace of the change.

Cons

- The slower speed of the change can hold the company back.

- Employees can get tired of the never-ending change initiatives and become demotivated.

- Can be challenging to go through all the stages and tempting to abandon halfway through.

Notes on the strategy

Integrating with existing digital solutions

The roadmap describes a situation when a bank has not started any transformation at all: there is just a basic website and no support for mobile platforms. A dedicated development team is probably the best delivery model for this strategy.

In reality, this is rarely the case. Most banks have taken steps towards better online services. Keep in mind, this doesn’t change the overall transformational strategy described in this post. You can integrate any existing digital solutions in the bank’s arsenal with the new platform. This can decrease or increase the timeframe of the first stage depending on the case.

Choosing the first platform

In most cases, it makes sense to start with the mobile platform and add web functionality at the later stages. However, in some cases it may be vice versa. It remains for the bank’s management to decide which platform they need first: web, iOS, or Android.

This does not affect the overall strategy though. You still start with one platform (web, in this case) and add others at the later stages.

Additional materials

Find the key points of this banking digital transformation in the October 2017 SlideShare presentation on the N-iX SlideShare channel.

About the author

Post by Konstantin Didur, senior marketing manager at N-iX.

Konstantin has 8 years of digital marketing experience in software development, insurance, and automotive industries.

You can connect with him on Twitter or on LinkedIn.

This article was originally posted on the N-iX website under the title “Is This the Best Way to Do Digital Transformation in Banking?” in September 2017. It is slighly adapted and reposted with permission. This entry is not sponsored. Top image: Shutterstock – Copyright: nmedia – All other images are the property of N-iX or their respective mentioned owners.