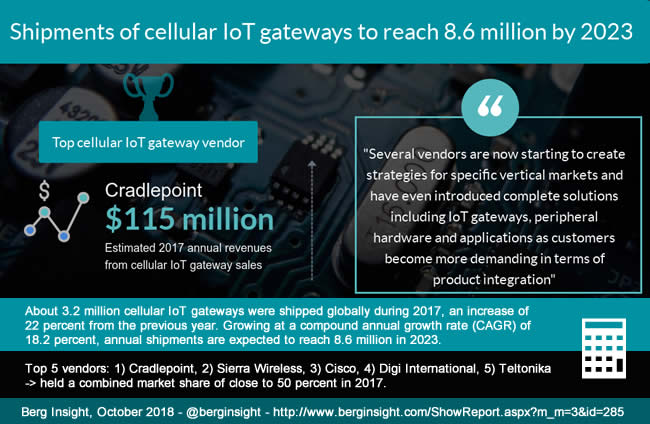

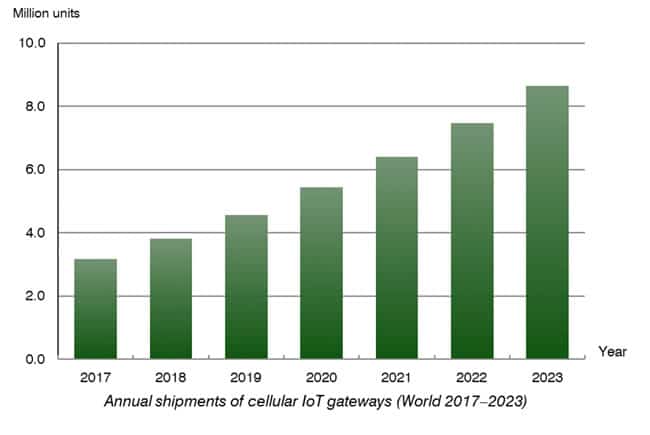

According to a report, released in October 2018, shipments of cellular IoT gateways are expected to reach 8.6 million by 2023. The report by leading M2M/IoT market research provider Berg Insight is based upon a vendor survey.

It shows that across all regions and verticals 2017 has been a good year for the market with approximately 3.2 million cellular IoT gateways, routers and modems shipped, a pretty impressive growth of 22 percent compared to 2016.

During the forecast period a two-digit CAGR of 18.2 percent is expected, resulting in the mentioned forecasted 8.6 million shipments by 2023. Berg Insights defines cellular IoT gateways as “standalone devices intended for connecting M2M applications to a cellular network”.

Berg Insight forecasts that shipments of cellular IoT gateways will grow at a CAGR of 18.2 percent in the next five years to reach 8.6 million units in 2023

On a regional level, North American vendors dominate their local cellular IoT gateway, router and modem market with Cradlepoint, Sierra Wireless, Cisco and Digi International being the largest vendors, Berg Insight states in a press release announcing the “The Global Cellular IoT Gateway Market – 3rd Edition” report. In Europe Teltonika leads the pack.

These five manufacturers accounted for approximately US$ 375 million in annual revenues from IoT gateway sales in 2017. According to the executive summary (more in the SlideShare below) Cradlepoint is the market leader with an estimated US$ 115 million in annual revenues from IoT gateway sales. Sierra Wireless follows with an estimated US$ 79 million in annual revenues.

Regional differences: the characteristics of the North American cellular IoT gateway, router and modem market

Globally the North American market experienced the slowest growth in 2017. However, the market is quite different from other regions as mentioned below.

Moreover, despite this slower growth compared to other regions, Berg Insight expects that the North American cellular IoT gateway, router and modem market “will remain the largest geographical market in terms of revenues in the foreseeable future”.

While the North American market is clearly dominated by large vendors, a different picture emerges when looking at Europe and Asia. Berg Insight points out that the dominance of a few large vendors is due to entry barriers in the form of carrier certifications required for cellular devices in North America. In Europe and the Asia-Pacific markets there are many small and medium sized vendors.

Fredrik Stålbrand, IoT Analyst, Berg Insight: “The average selling price for IoT gateways remains notably higher in North America compared to the European and the Asia-Pacific markets, primarily due to a higher share of feature-rich 4G LTE devices in the product mix”.

According to Stålbrand the carrier certifications in the US create economies of scale and diseconomies of scope, which has contributed to an industry characterized by several large companies offering standardized devices.

Stålbrand: “Several vendors are now starting to create strategies for specific vertical markets and have even introduced complete solutions including IoT gateways, peripheral hardware and applications as customers become more demanding in terms of product integration”.

The report covers the market of cellular IoT gateways, routers and modems and forecasts for the M2M module market. It also looks at the various players in the market. Among them (on top of the five mentioned ones) these include (per region):

- In the US: CalAmp, Multitech Systems and Encore Networks

- In the Asia-Pacific region: InHand Networks, Maestro Wireless, Four-Faith, Robustel Technologies and NetComm Wireless

- In Europe: HMS Networks, Advantech B+B SmartWorx, NetModule, Matrix Electrónica, Eurotech, Gemalto, Sagemcom Dr. Neuhaus, Option and Beijer Electronics Group.

Some market trends from the table of contents: Berg Insight sees vendors moving to employ vertical integration strategies in attractive niches and finds few new product launches of LTE-M and NB-IoT devices. Vendors also offer modularized devices for flexibility and upgradability. Finally, the pace of M&A activity in the market could pick up.

For the record: the mentioned definition of cellular IoT gateways is to be interpreted strictly. Berg Insight: “These include primarily general-purpose cellular routers, gateways and modems that are enclosed in a chassis and have at least one input/output port. Trackers, telematics devices and other specialized devices are excluded from this report”.

Disclaimer: we have no commercial relationships with any of the mentioned companies. However, Option was an i-SCOOP customer many years ago. All images belong to their mentioned owners.