Insurance companies struggle with the rapid pace of change within an increasingly demanding and digital market and customer context. Digital technologies and innovations, the increasing digital communications behavior of consumers, feedback and comparison websites, the list goes on.

Although the impact of such changes is big and leading to digital transformations in the industry, the whole digital dimension is just part of a bigger puzzle of challenges within the insurance market and, let’s face it, a world where the nature and number of risks has risen considerably.

Stepping up the pace of transformation: challenges

The lack of speed and ability to adapt rapidly to changing circumstances has several causes. Among them is certainly the very nature of the insurance business itself.

Providing coverage for risk is a numbers business. Whereas in many insurance areas, the risks – and along with it insurance policy prices are well-known, how do you “cover” people and protect your business continuity for the unknown? In that sense it’s not a surprise that Big Data and mainly analytics (including predictive analytics) rank high on the insurance CIO’s priority list.

A second reason for the gap between the speed of change in many societal areas on one hand and the ability to adapt to them on the other is the sheer size of many insurance organizations and the ways they work and rely on legacy systems that often slow them down.

Thirdly, the insurance industry has been facing several challenges over the last decade, ranging from multiple regulatory changes and the financial crisis to changing geopolitical realities. While some of these also affect other industries, the insurance industry and financial services industry in general, has been – successfully – dealing with regulatory changes and face new ones.

Global business risks 2015 – focus on insurance

Still, the risks of not being able to adapt faster are real and insurance companies know it as one of their jobs is to assess risks. Especially in corporate insurance, many publish report after report about the risks regarding cybersecurity, digital technology, geopolitical evolutions and the challenges for business – just like them – overall.

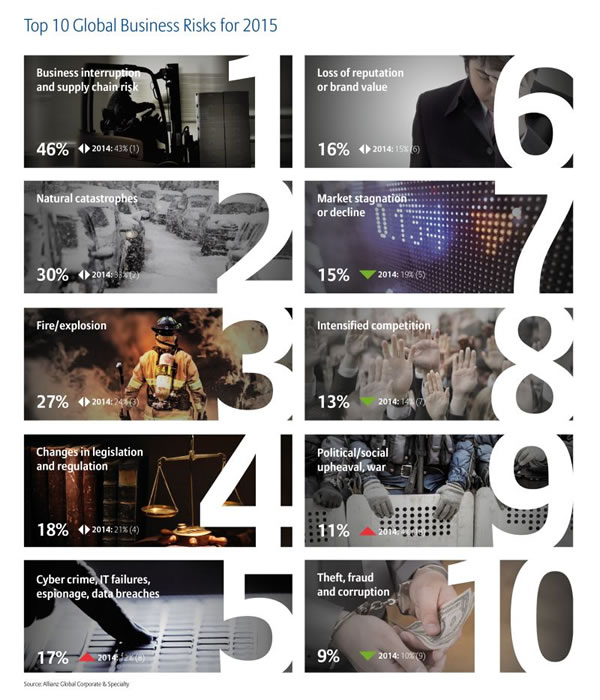

Noteworthy example in that context: according to insurance giant Allianz, the top 10 global business risks for 2015 are, in order of decreasing importance:

- Business interruption and supply chain risk.

- Natural catastrophes.

- Fire/explosion.

- Changes in legislation and regulation.

- Cybercrime, IT failures, espionage and data breaches.

- Loss of reputation or brand value.

- Market stagnation or decline.

- Intensified competition.

- Political/social upheaval, war.

- Theft, fraud and corruption.

At least 6 of those are serious risks and challenges for the insurance industry itself. When looking ahead at the risks for the future, Allianz mentions technological innovation as the cause of further disruption. In fact, technological innovation as a risk gets one page in the 15 page document about the analysis.

And I quote: “Technological innovation appears in the top five long-term risks facing businesses, ranking 4th, the only time this appears in a top five of all risks analyzed”.

Technological evolution and financial services: a double-edged sword

In other words: technological innovation is perceived as a threat in the long run by most businesses. Obviously this is among others a matter of the security risks in a context of fast technological innovation, along with the increasing globalization and interconnectivity (and thus reliance on digital technologies, the backbone of that connected, digital business).

The opportunities of new technologies – and their impact on people, business and society – are of course not forgotten but it indicates how organizations struggle with the overall impact of this double-edged sword called technological innovation. The term “disruptions” is used more than once in the Allianz report.

For business that are active in the ‘digital economy’ it’s crucial to keep that in mind and recognize that there are many doubts and selling benefits alone won’t always cut it. Technological evolution is not just seen as a risk in the sense of security. Let’s face it: many organizations also fear the impact of technological innovation on their business models and bottom-line. They know there is no other choice than to evolve and step up their pace in order to close the gaps between where they stand and the speed at which digital evolutions take place in the lives of customers and the markets in which they operate.

Allianz (PDF opens) also looked at the key risks per industry and for financial services, including insurance, they are, again in order of decreasing importance:

- Changes in legislation and regulation.

- Cybercrime, IT failures, espionage and data breaches.

- Market stagnation or decline.

- Business interruption and supply chain.

- Market fluctuations (such as foreign exchange rates).

Many of these risks indeed seem to correspond with the challenges in the insurance industry itself. Yet, there are more from that top 10 list overall, mentioned earlier.

Digital and consumer behavior – reputation and commoditization

In the insurance industry (and we mainly focus on P&C or Property and Casualty insurance), loss of reputation and brand value is a genuine fear.

And it’s not just about the potential impact of data breaches and IT failures (according to the Allianz report, loss of reputation is seen as the main cost of cyber-attacks).

It’s also about recommendation and review websites, the impact of poor customer experiences, the consequences of slow claims processing, especially during “peak periods”, etc. With an increasingly demanding consumer, changing communications behavior, the advent of social media and more, the consumer reality is changing fast as well.

As if it isn’t enough, in these digital business times, the ways people “buy” insurances and the rise of alternative and often powerful players, “disrupting” the market add even more challenges. Think about the tech giants of this world, who are joined by InsurTech (FinTech for insurance) start-ups. As said, insurance company CIOs and C-level execs are at the same time looking at digital technologies to solve many of their challenges and, maybe even more importantly, to be more customer-oriented, competitive, innovative and efficient in times where several products and services are increasingly seen and treated as commodities.

However, for many consumers insurances are looked upon as something you unfortunately have to pay for. And pricing becomes the key criterion in such a commoditized context. The perception of insurances as commodities is further strengthened by the many, often “digital” intermediaries and comparison websites.

Among the digital transformation challenges and opportunities, the customer experience is certainly key in the insurance industry for the mentioned reasons of “disruptive” models and most importantly, commoditization. Other digital transformation challenges and opportunities include coupling pricing models with technologies such as telematics or with the actual “risk” behavior of the consumer, the mobile challenge and data (+analytics).

Top image: Shutterstock – Copyright: Ditty_about_summer – All other images are the property of their respective mentioned owners.