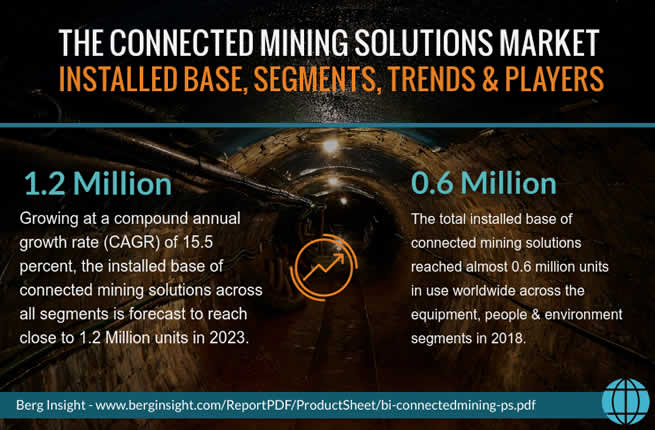

According to Berg Insight the total installed base of connected mining solutions reached almost 0.6 million units in use across the globe in 2018. For 2023 way over 1 million units are expected. An overview with trends, leading segments and players.

Connected mining encompassing various integrated and, indeed, connected mining solutions whereby people (e.g. safety, location, productivity), processes, big data, equipment of all sorts (stationary and mobile, including vehicles, for instance) and, increasingly, environment (which Berg Insight covers) play in the digital transformation of the mining industry.

The top players in the connected mining space include strikingly different types of companies, ranging from specialized independent technology suppliers of varying sizes up to the leading mining equipment manufacturers.

Obviously, industrial IoT and the integration of IT and OT, big data, (predictive) analytics, maintenance and other elements which you would typically find in an Industry 4.0 environment all play a role here too; yet the players Berg Insight looks at are specialized in surface mining, underground mining or both. An example of a connected mine is the underground copper and gold mine in Bulgaria of Dundee Precious Metals. Note: “the connected mine” is also the name some companies give to their offering for the mining industry. Rockwell Automation is one of them. Also Accenture has a “Connected Mine” suite. And they’re not the only ones.

Yet, Berg Insight covers the space of connected mining across the segments mentioned below. In a new report, announced end May 2019, the IoT analyst company covers the latest developments regarding the market for connected solutions used in the mining industry.

This includes an overview of the installed base and the ways this installed base will develop, along with the drivers and trends, techniques and equipment, and information on the various players in the connected mining solution ecosystem.

Connected mining solutions per segment and forecasts

The worldwide installed base of nearly 0.6 million connected mining solutions is across the equipment, people and environment segments. The mining equipment segment accounts for the largest share of the total Berg Insight states.

It represents connected devices deployed on machines and vehicles used in mining operations. This includes solutions ranging from OEM telematics systems on mining equipment to advanced connected solutions supplied by mining technology specialists.

The underground mining segment is in general less mature and more fragmented.

The people segment in connected mining consists of various solutions deployed to support the safety and productivity of mining personnel. The environment segment, finally, includes sensor technology implemented for environmental monitoring of the mine itself.

Looking ahead, Berg Insight forecasts the installed base of connected mining solutions across the three mentioned segments to reach nearly 1.2 million units in 2023. This means a compound annual growth rate (CAGR) of 15.5% through the forecast period.

From a geographical perspective the connected mining solution installed base is highest in the Asia-Pacific region. North America has the second largest share of the installed base of connected mining solutions and is followed by respectively the Middle East & Africa, Latin America and Europe.

Going underground and/or staying at the surface: a diverse connected mining player landscape

Berg Insight also points to the variety of players involved in the connected mining solutions space. The report also covers this, as well as the types of players involved in the overall connected mining value chain.

The top players active in the connected mining space include strikingly different types of companies, ranging from specialized independent technology suppliers of varying sizes up to the leading mining equipment manufacturers Berg Insight says. “Many of the key players today serve both surface and underground mining customers”, said Rickard Andersson, Principal Analyst, Berg Insight.

The surface segment is dominated by Modular Mining Systems (owned by Komatsu), Hexagon Mining, Wenco International Mining Systems (owned by Hitachi Construction Machinery) and Caterpillar through its Cat MineStar suite.

Modular, Hexagon and Caterpillar all serve underground customers in addition to a primary presence in the surface segment, while Wenco is fully focused on surface mining. VIST Group is also a player in the surface segment and serves some underground operations too.

Examples of key technology providers which are specifically focused on underground applications are Newtrax Technologies (recently acquired by Sandvik) and Mobilaris (partially owned by Epiroc).

The underground segment is in general less mature and more fragmented Berg Insight states.

Mine Site Technologies, MICROMINE and rapidBizApps are additional strong players in the underground segment that all also serve surface customers to varying extents.

More about the report, “The Connected Mining Solutions Market”, in the PDF.